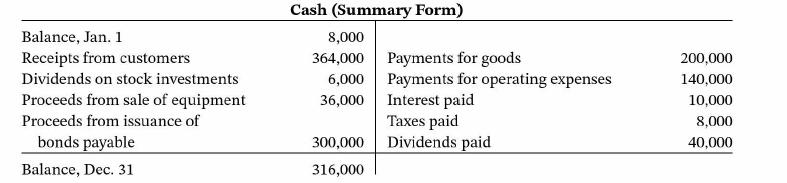

The following T-account is a summary of the Cash account of Alixon Company. What amount of net

Question:

The following T-account is a summary of the Cash account of Alixon Company.

What amount of net cash provided (used) by financing activities should be reported in the statement of cash flows?

Transcribed Image Text:

Balance, Jan. 1 Receipts from customers Dividends on stock investments Proceeds from sale of equipment Proceeds from issuance of bonds payable Balance, Dec. 31 Cash (Summary Form) 8,000 364,000 6,000 36,000 300,000 316,000 Payments for goods Payments for operating expenses Interest paid Taxes paid Dividends paid 200,000 140,000 10,000 8,000 40,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 64% (14 reviews)

The net cash provided used by financing activities i...View the full answer

Answered By

Maurat Ivan

I have been working in the education and tutoring field for the past five years, and have gained a wealth of experience and knowledge in this area. I have a bachelor's degree in education, and have completed additional coursework in teaching and tutoring.

In my previous roles, I have worked as a teacher in both private and public schools, teaching a variety of subjects including math, science, and English. I have also worked as a private tutor, providing one-on-one tutoring to students in need of additional support and guidance.

In my current role, I work as an online tutor, providing virtual tutoring services to students around the world. I have experience using a variety of online tutoring platforms and technologies, and am comfortable working with students of all ages and skill levels.

I am passionate about helping students succeed and reach their full potential, and I believe that my education and tutoring experience make me an excellent candidate for a tutoring job at SolutionInn. I am confident that my knowledge, skills, and experience will enable me to provide top-quality tutoring services to students on the SolutionInn platform.

0.00

0 Reviews

10+ Question Solved

Related Book For

Accounting Principles

ISBN: 9781119707110

14th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Jill E. Mitchell

Question Posted:

Students also viewed these Business questions

-

The following T account is a summary of the cash account of Holmes Company. What amount of net cash provided (used) by financing activities should be reported in the statement of cashflows? Cash...

-

The following T account is a summary of the cash account of Wiegman Company. What amount of net cash provided (used) by financing activities should be reported in the statement of cashflows? Cash...

-

Find the derivatives of the function. 9 cot sin t t

-

A Ltd. received the following dividend income during the current year: $1,000 of eligible dividends from a taxable Canadian corporation $1,000 of non-eligible dividends from a taxable Canadian...

-

A submerged arc welding operation takes place on 10 mm thick stainless steel plate, producing a butt weld as shown in Fig. 12.20c. The weld geometry can be approximated as a trapezoid with 15 mm and...

-

A plc and B Ltd are two businesses similar in size, activity, gearing and dividend cover. A plc is Stock Exchange listed, B Ltd is not. The dividend yield (gross) for A plc is 10 per cent, and B Ltd...

-

Del Spencer is the owner and founder of Del Spencers Mens Clothing Store. Del Spencers has its own house charge accounts and has found from past experience that 10 percent of its sales are for cash....

-

What was the nature of the questionable transactions involved in this case? A. Improper capitalization of expenditures. B. Missing cash receipts. C. Fraudulent travel and entertainment reports. D....

-

The three stone blocks have weights WA, WB, and WC. Determine the smallest horizontal force P that must be applied to block C in order to move this block. The coefficient of static friction between...

-

Under IFRS: a . Taxes are always treated as an operating activity. b . The income statement uses the headings operating, investing, and financing. c . Dividends received can be either an operating or...

-

IFRS requires that noncash items: a . Be reported in the section to which they relate, that is, a noncash investing activity would be reported in the investing section. b . Be disclosed in the notes...

-

Slater Industries makes custom optical glass equipment. The company began two jobs during January 2004. There was no beginning inventory. The following information is available: Slaters estimated...

-

Dr. Burgess oversees the pharmacy center within Hughes Regional Hospital. Dr. Burgess is planning on purchasing two medication dispensing units which she wants to pay back in a short-term period. The...

-

On January 1, 2021, Wetick Optometrists leased diagnostic equipment from Southern Corp., which had purchased the equipment at a cost of $1,831,401. The lease agreement specifies six annual payments...

-

Prevosti Farms and Sugarhouse pays its employees according to their job classification. The following employees make up Sugarhouse's staff: Employee Whatis late and Address Payroll information A -...

-

Image caption

-

Jamie Lee and Ross, now 57 and still very active, have plenty of time on their hands now that the triplets are away at college. They both realized that time has just flown by, over twenty-four years...

-

A model airplane is flying horizontally due north at 20 mi/hr when it encounters a horizontal crosswind blowing east at 20 mi/hr and a downdraft blowing vertically downward at 10 mi/hr. a. Find the...

-

Parkin Industries, a U.S. company, acquired a wholly-owned subsidiary, located in Italy, at the beginning of the current year, for 200,000. The subsidiary's functional currency is the euro. The...

-

Tracy Harper has a $39,000 capital balance in a partnership. She sells her interest to Kim Remington for $45,000 cash. What entry is made by the partnership for this transaction?

-

Tracy Harper has a $39,000 capital balance in a partnership. She sells her interest to Kim Remington for $45,000 cash. What entry is made by the partnership for this transaction?

-

Debbie Perry retires from the partnership of Garland, Newlin, and Perry. She receives $85,000 of partnership assets in settlement of her capital balance of $77,000. Assuming that the income-sharing...

-

Just work out the assignment on your own sheet, you dont need the excel worksheet. Classic Coffee Company Best friends, Nathan and Cody, decided to start their own business which would bring great...

-

Financial information related to the proprietorship of Ebony Interiors for February and March 2019 is as follows: February 29, 2019 March 31, 2019 Accounts payable $310,000 $400,000 Accounts...

-

(b) The directors of Maureen Company are considering two mutually exclusive investment projects. Both projects concern the purchase of a new plant. The following data are available for each project...

Study smarter with the SolutionInn App