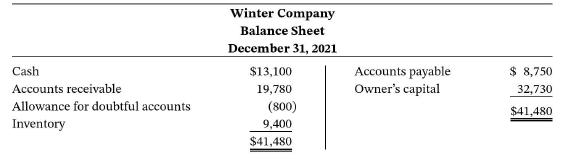

Winter Company's balance sheet at December 31, 2021, is presented below. During January 2022, the following transactions

Question:

Winter Company's balance sheet at December 31, 2021, is presented below.

During January 2022, the following transactions occurred. Winter uses the perpetual inventory method.

Jan. 1 Winter accepted a 4-month, 8% note from Merando Company in payment of Merando's $1,200 account.

3 Winter wrote off as uncollectible the accounts of Inwood Corporation ($450) and Goza Company ($280).

8 Winter purchased $17,200 of inventory on account.

11 Winter sold for $28,000 on account inventory that cost $19,600.

15 Winter sold inventory that cost $700 to Mark Lauber for $1,000. Lauber charged this amount on his Visa First Bank card. The service fee charged Winter by First Bank is 3%.

17 Winter collected $22,900 from customers on account. No sales discounts were allowed.

21 Winter paid $14,300 on accounts payable. No purchase discounts were taken.

24 Winter received payment in full ($280) from Goza Company on the account written off on January 3.

27 Winter purchased supplies for $1,400 cash.

31 Winter paid other operating expenses, $3,718.

Adjustment data:

1. Interest is recorded for the month on the note from January 1.

2. Uncollectibles are expected to be 6% of the January 31, 2022, accounts receivable.

3. A count of supplies on January 31, 2022, reveals that $560 remains unused.

Instructions

a. Prepare journal entries for the transactions listed above and adjusting entries.

b. Prepare an adjusted trial balance at January 31, 2022.

c. Prepare a multiple-step income statement and an owner's equity statement for the month ending January 31, 2022, and a classified balance sheet as of January 31, 2022.

Step by Step Answer:

Accounting Principles

ISBN: 9781119707110

14th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Jill E. Mitchell