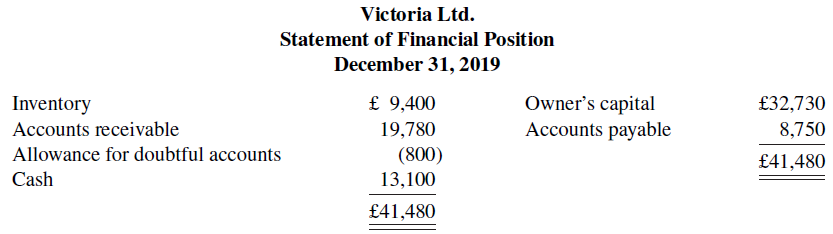

Victoria Ltd.s statement of financial position at December 31, 2019, is presented below. During January 2020, the

Question:

Victoria Ltd.’s statement of financial position at December 31, 2019, is presented below.

During January 2020, the following transactions occurred. Victoria uses the perpetual inventory method.

Jan. 1 Victoria accepted a 4-month, 8% note from Merando Company in payment of Merando’s £1,200 account.

3 Victoria wrote off as uncollectible the accounts of Inwood Corporation (£450) and Goza Company (£280).

8 Victoria purchased £17,200 of inventory on account.

11 Victoria sold for £28,000 on account inventory that cost £19,600.

15 Victoria sold inventory that cost £700 to Mark Lauber for £1,000. Lauber charged this amount on his Visa First Bank card. The service fee charged Victoria by First Bank is 3%.

17 Victoria collected £22,900 from customers on account.

21 Victoria paid £16,300 on accounts payable.

24 Victoria received payment in full (£330) from Elmo on the account written off on January 3.

27 Victoria purchased supplies for £1,400 cash.

31 Victoria paid other operating expenses, £3,218.

Adjustment data:

1. Interest is recorded for the month on the note from January 1.

2. Bad debts are expected to be 5% of the January 31, 2020, accounts receivable.

3. A count of supplies on January 31, 2020, reveals that £470 remains unused.

Instructions

(You may want to set up T-accounts to determine ending balances.)

a. Prepare journal entries for the above transactions and the adjusting entries. (Include entries for cost of goods sold using the perpetual system.)

b. Prepare an adjusted trial balance at January 31, 2020.

c. Prepare an income statement and an owner’s equity statement for the month ending January 31, 2020, and a classified statement of financial position as of January 31, 2020.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Accounting Principles

ISBN: 978-1119419617

IFRS global edition

Authors: Paul D Kimmel, Donald E Kieso Jerry J Weygandt