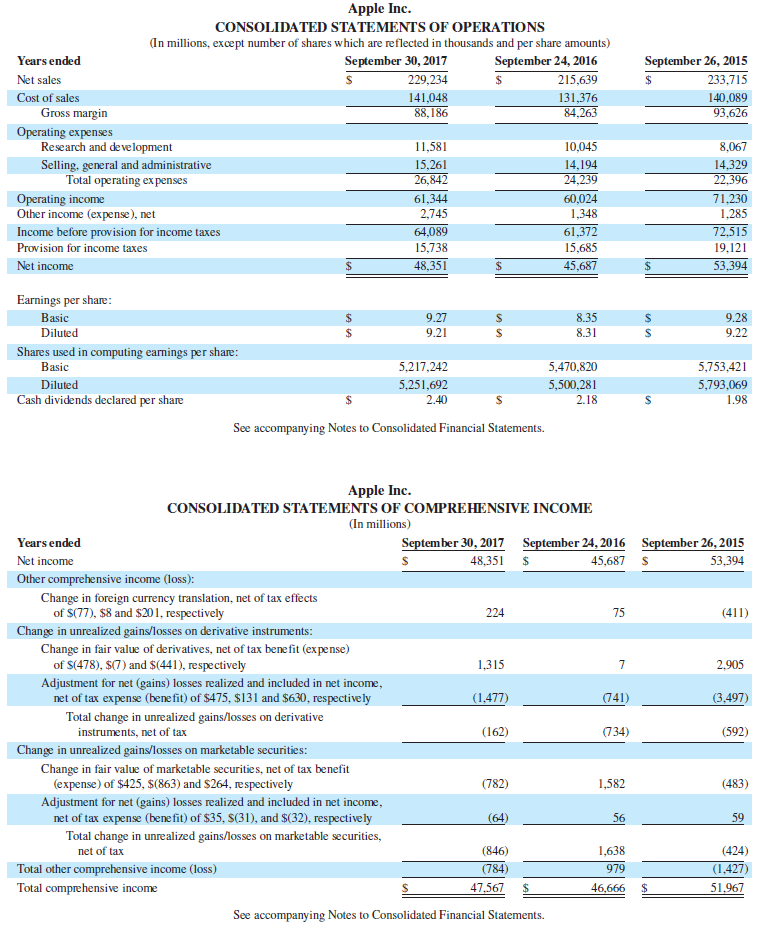

Fundamental Accounting Principles 17th Edition Kermit D. Larson, John J Wild, Barbara Chiappetta - Solutions

Discover comprehensive solutions and answers for "Fundamental Accounting Principles 17th Edition" by Kermit D. Larson, John J Wild, and Barbara Chiappetta. Access our online solutions manual and answers key to navigate through solved problems with ease. Benefit from step-by-step answers in our chapter solutions and instructor manual, designed to enhance your understanding. Explore our test bank for thorough preparation. All solutions and answers are available in a convenient PDF format for free download, making your study of this essential textbook both accessible and effective.

![]()

![]() New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

![]()

![]()