Part 1. On January 2, Gannon Co. purchases and installs a new machine costing $312,000 with a

Question:

Part 1. On January 2, Gannon Co. purchases and installs a new machine costing $312,000 with a five-year life and an estimated $28,000 salvage value. Management estimates the machine will pro¬ duce 1,136,000 units of product during its life. Actual production of units is as follows: year 1,245,600; year 2, 230,400; year 3, 227,000; year 4, 232,600; and year 5, 211,200. The total number of units produced by the end of year 5 exceeds the original estimate—this difference was not predicted. (The machine must not be depreciated below its estimated salvage value.)

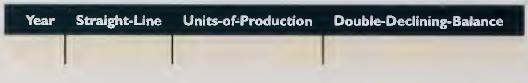

Required Prepare a table with the following column headings and compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method.

Part 2. On January 1, Gannon purchases a used machine for $130,000 and readies it for use the next day at a cost of $3,390. On January 4. it is mounted on a required operating platform costing $4,800, and it is readied for operations. Management estimates the machine will be used for seven years and have an $18,000 salvage value. Depreciation is to be charged on a straight-line basis. On December 31, at the end of its sixth year of use, the machine is disposed of.

Required

a. Prepare journal entries to record the machine’s purchase and the costs to ready and install it. Cash is paid for all costs incurred.

b. Prepare journal entries to record depreciation of the machine at December 31 of its first year in operations and at December 31 in the year of its disposal.

e. Prepare journal entries to record the machine’s disposal under each of the following separate as¬ sumptions: (i) it is sold for $30,000 cash; (ii) it is sold for $50,000 cash; and (iii) it is destroyed in a fire and the insurance company pays $20,000 cash to settle the loss claim.

Step by Step Answer:

Fundamental Accounting Principles

ISBN: 9780072946604

17th Edition

Authors: Kermit D. Larson, John J Wild, Barbara Chiappetta