On March 31, 2018, Gardner Corporation received authorization to issue $30,000 of 9 percent, 30-year bonds payable. The bonds pay interest on March 31

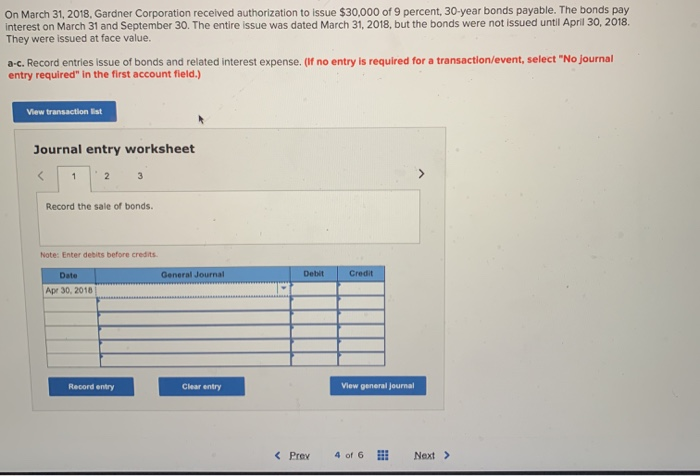

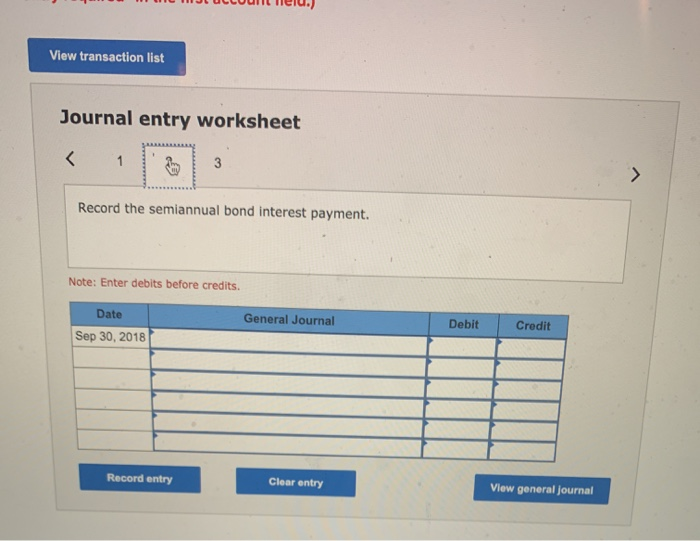

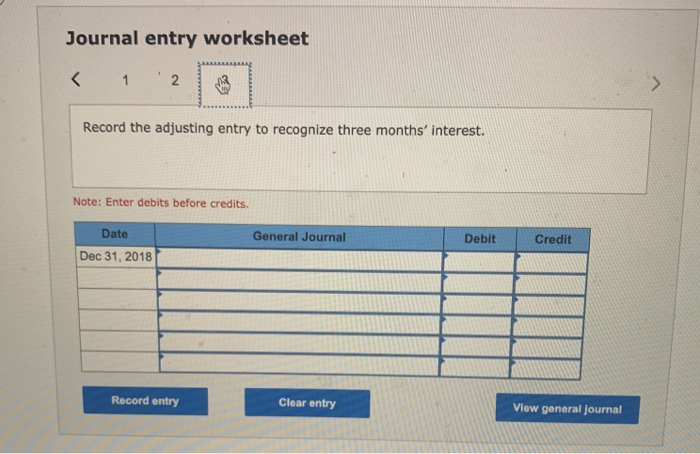

On March 31, 2018, Gardner Corporation received authorization to issue $30,000 of 9 percent, 30-year bonds payable. The bonds pay interest on March 31 and September 30. The entire issue was dated March 31, 2018, but the bonds were not issued until April 30, 2018. They were issued at face value. a-c. Record entries issue of bonds and related interest expense. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the sale of bonds. Note: Enter debits before credits Date General Journal Debit Credit Apr 30, 2018 Record entry Clear entry View general journal < Prev 4 of 6 Next> View transaction list Journal entry worksheet 1 3 Record the semiannual bond interest payment. Note: Enter debits before credits. Date General Journal Debit Credit Sep 30, 2018 Record entry Clear entry View general journal Journal entry worksheet < 1 2 Record the adjusting entry to recognize three months' interest. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2018 Record entry Clear entry View general journal

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

A D 1 Date Accounts title and Explanation Debit Credit 2 April 30 ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards