Maria Barto and J R Black are forming a partnership to which Barto will devote one-third time

Question:

Maria Barto and J R Black are forming a partnership to which Barto will devote one-third time and Black will devote full time. They have discussed the following alternative plans for sharing income and loss:

(a) in the ratio of their initial capital investments, which they have agreed will be $52 000 tor Barto and $78,000 for Black;

(b) in proportion to the time devoted to the business;

(c) a salary al- owance of $2,000 per month to Black and the balance in accordance with the ratio of their initial cap¬ ital investments; or

(d) a salary allowance of $2,000 per month to Black, 10% interest on their initial capital investments, and the balance shared equally. The partners expect the business to perform as follows: Year 1, $18,000 net loss; Year 2, $38,000 net income; and Year 3, $94,000 net income.

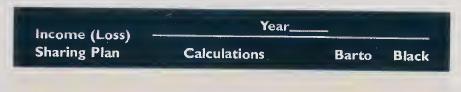

Required Prepare three tables with the following column headings:

Complete the tables, one for each of the first three years, by showing how to allocate partnership in¬ come or loss to the partners under each of the four plans being considered. (Round answers to the nearest whole dollar.)

Step by Step Answer:

Fundamental Accounting Principles

ISBN: 9780072946604

17th Edition

Authors: Kermit D. Larson, John J Wild, Barbara Chiappetta