JLK Company has five employees, each of whom earns $1,200 per month and is paid on the

Question:

JLK Company has five employees, each of whom earns $1,200 per month and is paid on the last day of each month. All five have been employed continuously at this amount since January 1. JLK uses a payroll bank account and special payroll checks to pay its employees. On June 1, the following ac¬ counts and balances exist in its general ledger:

a. FICA—Social Security Taxes Payable, $744; FICA—Medicare Taxes Payable, $174. (The bal¬ ances of these accounts represent total liabilities for both the employer’s and employees’ FICA taxes for the May payroll only.)

b. Employees’ Federal Income Taxes Payable, $900 (liability for May only).

c. Federal Unemployment Taxes Payable, $96 (liability for April and May together).

d. State Unemployment Taxes Payable, $480 (liability for April and May together).

During June and July, the company had the following payroll transactions:

June 15 Issued check payable to Security Bank, a federal depository bank authorized to accept em¬ ployers’ payments of FICA taxes and employee income tax withholdings. The $1,818 check is in payment of the May FICA and employee income taxes.

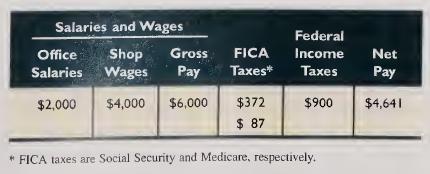

30 Recorded the June payroll and transferred funds from the regular bank account to the pay¬ roll bank account. Issued checks payable to each employee in payment of the June payroll. The payroll register shows the following summary totals for the June pay period:

Required Prepare journal entries to record the transactions and events for both June and July.

Step by Step Answer:

Fundamental Accounting Principles

ISBN: 9780072946604

17th Edition

Authors: Kermit D. Larson, John J Wild, Barbara Chiappetta