Review the chapters opening feature involving Andre Downey and Environmental, Engineering & Construction. EEC is considering a

Question:

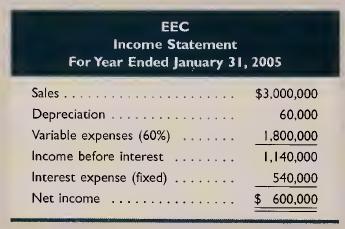

Review the chapter’s opening feature involving Andre Downey and Environmental, Engineering & Construction. EEC is considering a major technological investment in a plant asset to improve its environmental cleanup process. Assume that this investment would cut variable costs from 60% of sales to 45% of sales. However, fixed interest expense would increase from $540,000 per year to $1,140,000 per year to fund the $4,800,000 plant asset investment (with zero salvage, 50-year life, and depreciated using the straight-line method). Also assume that its recent income statement (absent this potential investment) appears as follows (assume zero income taxes):

Required 1. Compute EEC’s times interest earned ratio at January 31, 2005.

2. If EEC expects sales to remain at $3,000,000, what would net income and times interest earned equal if it makes the investment?

3. What would net income and times interest earned equal if sales increase to $3,600,000 and the investment is

(a) not made and

(b) made?

4. What would net income and times interest earned equal if sales increase to $4,639,998 and the investment is

(a) not made and

(b) made?

5. What would net income and times interest earned equal if sales increase to $5,400,000 and the investment is

(a) not made and

(b) made?

6. Comment on the results from parts 1 through 5 and their relation to the times interest earned ratio.

Step by Step Answer:

Fundamental Accounting Principles

ISBN: 9780072946604

17th Edition

Authors: Kermit D. Larson, John J Wild, Barbara Chiappetta