Choke Cherry Ltd. is a private company reporting under ASPE. Its adjusted trial balance at its fiscal

Question:

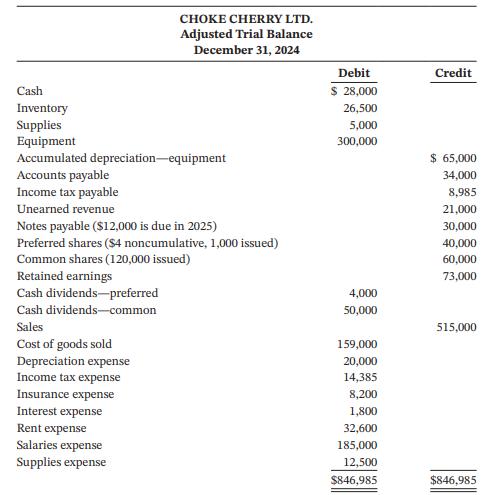

Choke Cherry Ltd. is a private company reporting under ASPE. Its adjusted trial balance at its fiscal year end, December 31, 2024, is shown below:

Instructions

Prepare a multi-step income statement, statement of retained earnings, and balance sheet.

Compare dividends paid to owners of corporations with withdrawals by owners of proprietorships or partnerships.

Cash Inventory Supplies Equipment Accumulated depreciation-equipment Accounts payable Income tax payable Unearned revenue CHOKE CHERRY LTD. Adjusted Trial Balance December 31, 2024 Notes payable ($12,000 is due in 2025) Preferred shares ($4 noncumulative, 1,000 issued) Common shares (120,000 issued) Retained earnings Cash dividends-preferred Cash dividends-common Sales Cost of goods sold Depreciation expense Income tax expense Insurance expense Interest expense Rent expense Salaries expense Supplies expense Debit $ 28,000 26,500 5,000 300,000 4,000 50,000 159,000 20,000 14,385 8,200 1,800 32,600 185,000 12,500 $846,985 Credit $ 65,000 34,000 8,985 21,000 30,000 40,000 60,000 73,000 515,000 $846,985

Step by Step Answer:

Sales Cost of goods sold Gross profit Operating expenses CHOKE CHE...View the full answer

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Choke Cherry Ltd. is a private company reporting under ASPE. Its adjusted trial balance at its fiscal year end, December 31, 2014, is shown below: Instructions (a) Prepare an income statement,...

-

Choke Cherry Ltd. is a private company reporting under ASPE. Its adjusted trial balance at its fiscal year end, December 31, 2017, is shown below: Instructions Prepare an income statement, statement...

-

Choke Cherry Ltd. is a private company reporting under ASPE. Its adjusted trial balance at its fiscal year end, December 31, 2021, is shown below: Instructions Prepare an income statement, statement...

-

Question 13 Case Study - Little Pear Administration Pty Ltd (LPA) You are the payroll officer for Little Pear Administration Pty Ltd (LPA). Debra Foy is a company employee and has approached you with...

-

True Value Investment Properties Inc. and its subsidiaries have provided you with a list of the properties they own: (a) Land held by True Value for undetermined future use (b) A vacant building...

-

Which of Fayols 14 Principles of Management were demonstrated at Belton Hospital? Which ones were missing from United Oak Hospital? During the COVID-19 pandemic, two hospitals in the same large...

-

Unless they use IFRS, foreign companies with securities listed in the United States (in the form ofADRs) are required to reconcile their net income and stockholders equity to U.S. GAAP in the annual...

-

Assume that a security model is needed for the protection of information in your class. Using the CNSS model, examine each of the cells and write a brief statement on how you would address the three...

-

Hi please help with the following. All of the information is below and the balance sheet needs to be filled out. 1 Problem 2-30 (Algo) (LO 2-4,2-5, 2-7, 2-8) Pratt Company acquired all of the...

-

Superior Hardwood Company distributes hardwood products to small furniture manufacturers. The adjusted trial balance data given below is from the firms worksheet for the year ended December 31, 2019....

-

Rupert Engineering Corp. is a private company reporting under ASPE. Its adjusted trial balance at its fiscal year end, March 31, 2024, is show Instructions Prepare a multi-step income statement,...

-

Alverstone Inc. has the following shares outstanding: 54,000 common and 18,000 $0.75 cumulative preferred. On December 15, the directors declared dividends of $64,800 to the shareholders of record on...

-

The Retained Earnings balance at the end of last year was $50,000. In June of this year, well after last years books were closed, it was found that a mistake had been made in computing depreciation...

-

Suppose that your credit card activity for December looked like this: Date Activity December 5 $384 purchase December 11 $347 purchase December 16 $174 purchase December 21 $480 purchase December 25...

-

A research group surveyed 300 students. The students were asked how often they go to the movies and whether they prefer comedies or dramas. Their responses are summarized in the following table....

-

C. Prove the following (you can use any formal induction/other theoretical method, "A" means power here): i. ii. iii. What is the time complexity recurrence relation for Fibonacci numbers? Explain it...

-

You and your partner run a small business together, with separate work roles. You are responsible for the business budget and have researched an improved budget process which you felt needs to be...

-

The actual selling expenses incurred in March 2022 by Carla Vista Company are as follows: Variable Expenses Fixed Expenses Sales commissions Advertising $14,576 Sales salaries $34,700 12.174...

-

You developed classes that work with catering event information for Carlys Catering. Now modify the Event and EventDemo classes as follows: Modify the Event class to include an integer field that...

-

Condensed financial data follow for E-Perform Ltd. E- Perform reports under ASPE. Additional information: 1. New equipment costing $85,000 was purchased for $25,000 cash and a $60,000 note payable....

-

Condensed financial data follow for Galenti Inc. Galenti is a private company reporting under ASPE. Additional information: 1. Short-term investments (reported at cost) were sold for $15,000,...

-

The financial statements of Milk River Ltd. follow: Additional information: 1. Equipment costing $24,000 was purchased with an $8,000 down payment and the remainder was financed with a note payable....

-

En prenant un exemple de votre choix, montrer comment on value un swap de taux de change.

-

How much would you need to invest today in order to receive: a. $10,000 in 5 years at 11%? b. $11,000 in 12 years at 8%? c. $12,000 each year for 10 years at 8%? d. $12,000 at the beginning of each...

-

A company that manufactures pulse Doppler insertion flow meters uses the Straight Line method for book depreciation purposes. Newly acquired equipment has a first cost of $190,000 with a 3-year life...

Study smarter with the SolutionInn App