Rupert Engineering Corp. is a private company reporting under ASPE. Its adjusted trial balance at its fiscal

Question:

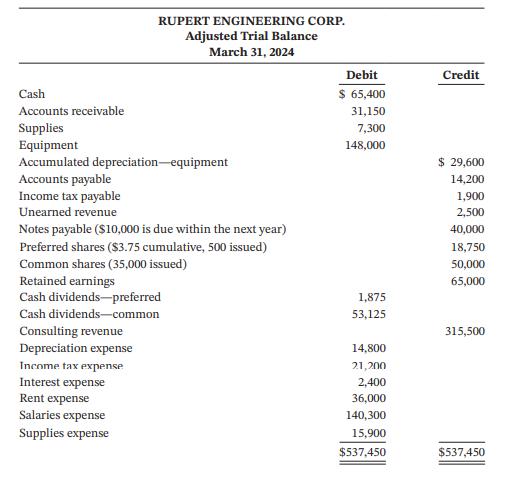

Rupert Engineering Corp. is a private company reporting under ASPE. Its adjusted trial balance at its fiscal year end, March 31, 2024, is show

Instructions

Prepare a multi-step income statement, statement of retained earnings, and balance sheet.

Are there any differences between the Retained Earnings account for corporations and the owner’s capital account used for proprietorships?

Cash Accounts receivable Supplies Equipment Accumulated depreciation-equipment Accounts payable Income tax payable Unearned revenue RUPERT ENGINEERING CORP. Adjusted Trial Balance March 31, 2024 Notes payable ($10,000 is due within the next year) Preferred shares ($3.75 cumulative, 500 issued) Common shares (35,000 issued) Retained earnings Cash dividends-preferred Cash dividends-common Consulting revenue Depreciation expense Income tax expense Interest expense Rent expense Salaries expense Supplies expense Debit $ 65,400 31,150 7,300 148,000 1,875 53,125 14,800 21,200 2,400 36,000 140,300 15,900 $537,450 Credit $ 29,600 14,200 1,900 2,500 40,000 18,750 50,000 65,000 315,500 $537,450

Step by Step Answer:

The owners capital for proprietorships and retained earnings for corporations both track the cumulat...View the full answer

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Rupert Engineering Corp. is a private company reporting under ASPE. Its adjusted trial balance at its fiscal year end, March 31, 2014, is shown below: Instructions (a) Prepare an income statement,...

-

Rupert Engineering Corp. is a private company reporting under ASPE. Its adjusted trial balance at its fiscal year end, March 31, 2017, is shown below: Instructions Prepare an income statement,...

-

Rupert Engineering Corp. is a private company reporting under ASPE. Its adjusted trial balance at its fiscal year end, March 31, 2021, is shown below: Instructions Prepare an income statement,...

-

1. Calculate the budgeted nights booked: Maximum capacity (30 rooms) * Number of days per year (365) * Expected occupancy rate (80%) = 8760 nights. 2. Calculate the tariff revenues: Budgeted nights...

-

Identify whether the following costs should be treated as a capital expenditure or a revenue expenditure when they are incurred. (a) $13,000 paid to rearrange and reinstall machinery (b) $200 paid...

-

Discuss several changes you would recommend to Bronson to improve their strategic planning process. Excellence has always been a focus of Bronson Methodist Hospital, a not-for-profit tertiary...

-

Ramshare Company acquired equipment at the beginning of 2009 at a cost of $100,000. The equipment has a five-year life with no expected salvage value and is depreciated on a straight-line basis. At...

-

Described below are potential financial statement misstatements that are encountered by auditors in the audit of inventory and cost of goods sold. a. Management of a chain of discount department...

-

7. By using demand and supply graphs, discuss how interest rate differential between Malaysia and Thailand can both weaken and strengthen Malaysian Ringgit against Thai Baht with relevant theories....

-

The Davis Lamp Company (DLC) is a wholesale company that purchases lamps from the manufacturer and resells them to retail stores. The company has three inventory items: desk lamps, table lamps, and...

-

Didsbury Digital Ltd. has a September 30 fiscal year end and a 15% income tax rate. The following information is available for its 2024 year end: 1. Earned $529,000 of service revenue and incurred...

-

Choke Cherry Ltd. is a private company reporting under ASPE. Its adjusted trial balance at its fiscal year end, December 31, 2024, is shown below: Instructions Prepare a multi-step income statement,...

-

Gross profit joint cost allocation The Far West Milling Company processes soybeans into meal, oil, and animal feed. A 60-pound bushel yields an average of 45 pounds of meal, 10 pounds of oil, and 5...

-

(b) A cylindrical storage tank with base area 90 m is being filled with water through an entry duct with cross-section area 250 cm, as shown in Figure 3. Concurrently, water is being extracted from...

-

Po A cylinder/piston arrangement contains 5 kg of water at 100 C with x= 20%. Initially the piston of mass m, 75 kg rests on a set of stops (see figure). The outside pressure is 100 kPa, and the area...

-

TABLE 2 Present Value of an Annuity of $1 n 123456 8% 9% 0.925926 0.917431 4 7 8 9 10 11 12 13 14 15 16 17 11.652296 10.837770 10.105895 9.446649 12.165669 11.274066 10.477260 9.763223 18 19...

-

There are 4 suits (heart, diamond, clover, and spade) in a 52-card deck, and each suit has 13 cards. Suppose your experiment is to draw one card from a deck and observe what suit it is. Express the...

-

Write isotopic symbol of zirconium and how many neutrons are present in one atom of this isotope

-

a. You created a Die application that randomly throws five dice for the computer and five dice for the player. The application displays the values. Modify the application to decide the winner based...

-

How has the too-big-to-fail policy been limited in the FDICIA legislation? How might limiting the too-big-to-fail policy help reduce the risk of a future banking crisis?

-

Strong Shoes' comparative balance sheet is presented below. Strong reports under ASPE. Additional information: 1. Profit was $28,300. Dividends declared and paid were $26,400. 2. Equipment that cost...

-

Coyote Ltd., a private company reporting under ASPE, reported the following for the years ended May 31, 2017 and 2016. Additional information: 1. Profit for 2017 was $108,000. 2. Common shares were...

-

Refer to the information presented for Coyote Ltd. in P17-7A. Additional information: 1. Net sales for the year were $673,250. 2. Cost of goods sold for the year was $403,950. 3. Operating expenses,...

-

Determine the simple interest earned on $10,000 after 10 years if the APR is 15%

-

give me an example of 10 transactions from daily routine that we buy and put for me Liabilities + Owners' Equity + Revenues - Expenses

-

What is the Macaulay duration of a bond with a coupon of 6.6 percent, seven years to maturity, and a current price of $1,069.40? What is the modified duration? (Do not round intermediate...

Study smarter with the SolutionInn App