The following ratios are available for Amazon.com, Inc. and Apple Inc. for a recent year: Instructions a.

Question:

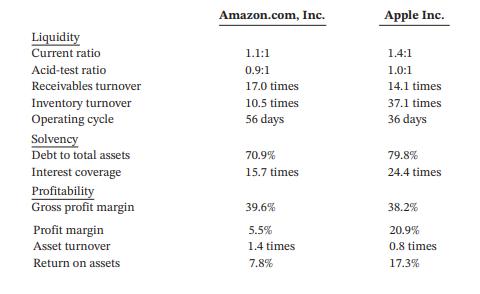

The following ratios are available for Amazon.com, Inc. and Apple Inc. for a recent year:

Instructions

a. Which company is more liquid? Explain.

b. Which company is more solvent? Explain.

c. Which company is more profitable? Explain.

Transcribed Image Text:

Liquidity Current ratio Acid-test ratio Receivables turnover Inventory turnover Operating cycle Solvency Debt to total assets Interest coverage Profitability Gross profit margin Profit margin Asset turnover Return on assets Amazon.com, Inc. 1.1:1 0.9:1 17.0 times 10.5 times 56 days 70.9% 15.7 times 39.6% 5.5% 1.4 times 7.8% Apple Inc. 1.4:1 1.0:1 14.1 times 37.1 times 36 days 79.8% 24.4 times 38.2% 20.9% 0.8 times 17.3%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 63% (11 reviews)

a Apple is more liquid with a better current ratio and acid...View the full answer

Answered By

ANDREW KIPRUTO

Academic Writing Expert

I have over 7 years of research and application experience. I am trained and licensed to provide expertise in IT information, computer sciences related topics and other units like chemistry, Business, law, biology, biochemistry, and genetics. I'm a network and IT admin with +8 years of experience in all kind of environments.

I can help you in the following areas:

Networking

- Ethernet, Wireless Airmax and 802.11, fiber networks on GPON/GEPON and WDM

- Protocols and IP Services: VLANs, LACP, ACLs, VPNs, OSPF, BGP, RADIUS, PPPoE, DNS, Proxies, SNMP

- Vendors: MikroTik, Ubiquiti, Cisco, Juniper, HP, Dell, DrayTek, SMC, Zyxel, Furukawa Electric, and many more

- Monitoring Systems: PRTG, Zabbix, Whatsup Gold, TheDude, RRDtoo

Always available for new projects! Contact me for any inquiries

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Question Posted:

Students also viewed these Business questions

-

The following ratios are available for toolmakers Best Tools, Inc. and Snappy Tools Incorporated, and their industry, for a recent year: Instructions (a) Which company is more liquid? Explain. (b)...

-

The following ratios are available for agricultural chemicals competitors Potash Corporation of Sas katchewan (Potash-Corp) and Agrium for a recent year: Instructions (a) Which company is more...

-

The following ratios are available for toolmakers Stanley Black & Decker and Snap-On for a recent year: Instructions (a) Which company is more liquid? Explain. (b) Which company is more solvent?...

-

Hughes Company has a credit balance of $5,000 in its Allowance for Doubtful Accounts before any adjustments are made at the end of the year. Based on review and aging of its accounts receivable at...

-

The beginning inventory for Tschabold Co. and data on purchases and sales for a two-month period are shown in Problem 6-3A. Round the average cost to two decimal places. In Problem 6-3 A The...

-

Do you agree that Inheritance violates the principle of equality of opportunity and that abolishing It would promote productivity and a disllibutlon of income that is fairer even by capitalist...

-

Selecting a Card A card is selected at random from a standard deck. Find each probability. (a) Randomly selecting a club or a 3 (b) Randomly selecting a red suit or a king (c) Randomly selecting a 9...

-

Kathy and Eddie formed the K & E partnership several years ago. Capital account balances on January 1, 2011, were as follows: Kathy ..... $496,750 Eddie ..... $268,250 The partnership agreement...

-

Company A requires a $10 million capital investment. Target Capital 60% debt, 40% equity 1 million shares of stock outstanding Net income is $6 million. The company follows a residual distribution...

-

On January 1, 2011, Price Company purchased an 80% interest in the common stock of Stahl Company for $1,040,000, which was $60,000 greater than the book value of equity acquired. The difference...

-

These selected condensed data are taken from recent balance sheets of Sally Sewing Ltd. (in thousands). Instructions Compute the current ratio for each year and comment on your results. Cash Accounts...

-

What is the difference between the current ratio and the acid-test ratio?

-

You are swimming in the ocean as water waves with wavelength 9.6 m pass by. What is the closest distance that another swimmer could be so that his motion is exactly opposite yours (he goes up when...

-

Find the derivative. 1 f(x)=(4x3+5x)1/3

-

(5.) The Alden Oil Company buys crude vegetable oil. The refining of this oil results in four products, A, B and C, which are liquids and D, which is heavy grease. The cost of the oil refined in 19_9...

-

Derivative of 4 0 0 0 / x + 4 0 + 0 . 1 x

-

covert the polar equation r = 8 3 c o s ( ) - 4 c o s ( ) t o cartesian

-

(2-4)2 <4 Let F (z) = e +4 4

-

Determine whether a taxpayer can change his or her election to itemize deductions once a return is filed.

-

The following information is for Montreal Gloves Inc. for the year 2020: Manufacturing costs Number of gloves manufactured Beginning inventory $ 3,016,700 311,000 pairs 0 pairs Sales in 2020 were...

-

Mila Company discovers in 2021 that its ending inventory at December 31, 2020, was overstated by $5,000. What effect will this error have on (a) 2020 profit, (b) 2021 profit, (c) The combined profit...

-

Collie Company incorrectly included $23,000 of goods held on consignment for Retriever Company in Collies beginning inventory for the year ended December 31, 2020. The ending inventory for 2020 and...

-

FirstIn Company reported profit of $90,000 in 2020. When counting its inventory on December 31, 2020, the company forgot to include items stored in a separate room in the warehouse. As a result,...

-

A proposed $2.5 M investment in new equipment at a 100 MG/y M&Ms factory will save the plant $800,000/y in energy costs. Assuming an annual interest rate of 5%/y (compounded annually), and an...

-

Brief Exercise 10-7 Coronado Company obtained land by issuing 2,250 shares of its $14 par value common stock. The land was recently appraised at $103,240. The common stock is actively traded at $44...

-

The following schedule reconciles Cele Co.'s pretax GAAP income Pretax GAAP income Nondeductible expense for fines Tax deductible depreciation in excess of GAAP depreciation expens Taxable rental...

Study smarter with the SolutionInn App