Moyle Co. acquired a machine on January 1, 2019, at a cost of $1,200,000. The machine is

Question:

Moyle Co. acquired a machine on January 1, 2019, at a cost of $1,200,000. The machine is expected to have a five-year useful life, with a salvage value of $75,000. The machine is capable of producing 1,500,000 units of product in its lifetime. Actual production was as follows: 300,000 units in 2019; 200,000 units in 2020; 400,000 units in 2021; 250,000 units in 2022; and 350,000 units in 2023.

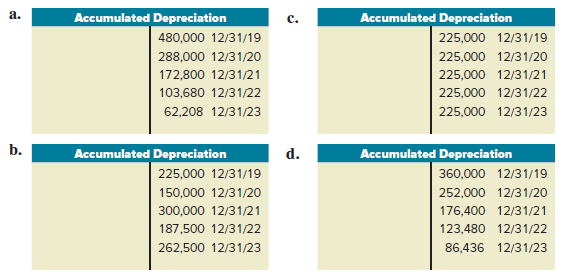

Items a through d below are T-account representations of Moyle Co.?s accumulated depreciation account. They reflect the depreciation adjustments that would be made each year for the above described machine using various depreciation calculation methods.

Required:

Identify the depreciation method that would result in each of these annual credit amount patterns to accumulated depreciation. If a declining-balance method is used, indicate the percentage (150% or 200%). (Hint: What do the amounts shown for each year represent?)

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Accounting What the Numbers Mean

ISBN: 978-1260565492

12th edition

Authors: David Marshall, Wayne McManus, Daniel Viele