On January 1, 2019, Carey Inc. entered into a noncancelable lease agreement, agreeing to pay $14,000 at

Question:

On January 1, 2019, Carey Inc. entered into a noncancelable lease agreement, agreeing to pay $14,000 at the end of each year for four years to acquire a new computer system having a market value of $40,800. The expected useful life of the computer system is also four years, and the computer will be depreciated on a straight-line basis with no salvage value. The interest rate used by the lessor to determine the annual payments was 14%. Under the terms of the lease, Carey has an option to purchase the computer for $1 on January 1, 2023.

Required:

a. Explain why Carey should account for this lease as a financing lease rather than an operating lease. (Hint: Determine which of the five criteria for capitalizing a lease have most likely been met.)

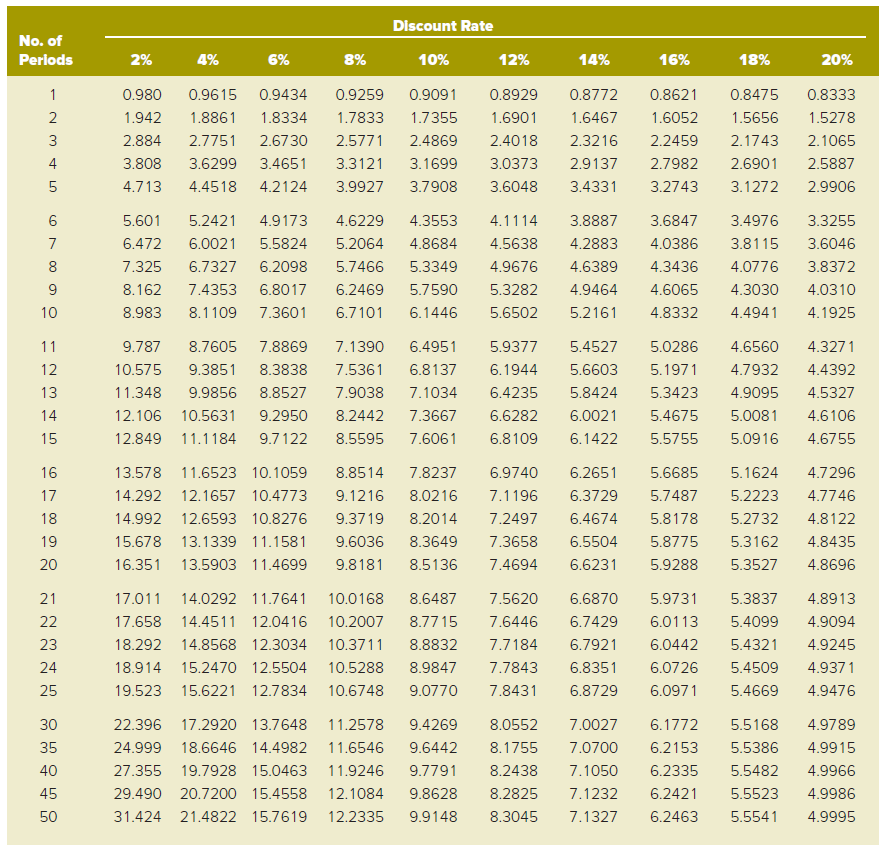

b. Show in a horizontal model or write the entry that Carey should make on January 1, 2019. Round your answer to the nearest $10. First determine the present value of future lease payments using Table 6-5.

c. Show in a horizontal model or write the entry that Carey, Inc., should make on December 31, 2019, to record the first annual lease payment of $14,000. Do not round your answers. (Hint: Based on your answer to part b, determine the appropriate amounts for interest and principal.)

d. What expenses (include amounts) should be recognized for this lease on the income statement for the year ended December 31, 2019?

e. Explain why the accounting for an asset acquired under a financing lease isn?t really any different than the accounting for an asset that was purchased with money borrowed on a long-term loan.

Table 6-5

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Accounting What the Numbers Mean

ISBN: 978-1260565492

12th edition

Authors: David Marshall, Wayne McManus, Daniel Viele