Ambrose Co. has the option of purchasing a new delivery truck for $63,450 in cash or leasing

Question:

Ambrose Co. has the option of purchasing a new delivery truck for $63,450 in cash or leasing the truck for $13,725 per year, payable at the end of each year for six years. The truck also has a useful life of six years and will be depreciated on a straight-line basis with no salvage value. The interest rate used by the lessor to determine the annual payments was 8%.

Required:

a. Assume that Ambrose Co. purchased the delivery truck and signed a six-year, 8% note payable for $63,450 in satisfaction of the purchase price. Show in a horizontal model or write the entry that Ambrose should make to record the purchase transaction.

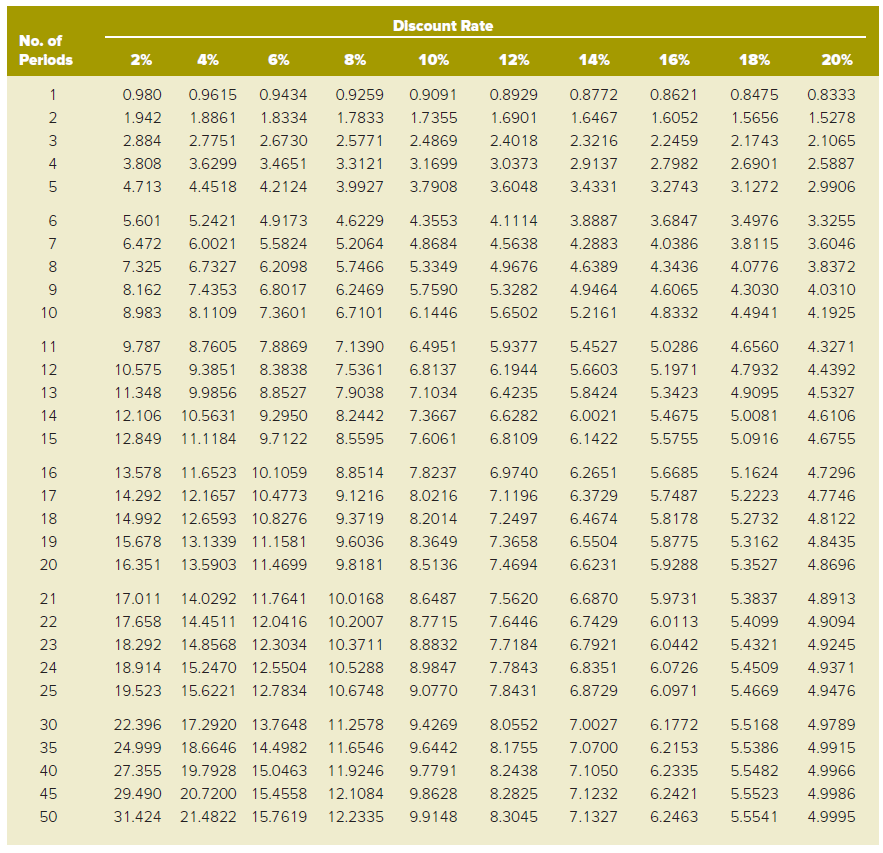

b. Assume instead that Ambrose Co. agreed to the terms of the lease. Show in a horizontal model or write the entry that Ambrose should make to record the financing lease transaction. Round your answer up to the nearest $10. First determine the present value of future lease payments using Table 6-5.

c. Show in a horizontal model or write the entry that Ambrose Co. should make at the end of the year to record the first annual lease payment of $13,725. Do not round your answers. (Hint: Based on your answer to part b, determine the appropriate amounts for interest and principal.)

d. What expenses (include amounts) should Ambrose Co. recognize on the income statement for the first year of the lease?

e. How much would the annual payments be for the note payable signed by Ambrose Co. in part a? Use the present value of an annuity factor from Table 6-5.

Table 6-5

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Annuity

An annuity is a series of equal payment made at equal intervals during a period of time. In other words annuity is a contract between insurer and insurance company in which insurer make a lump-sum payment or a series of payment and, in return,...

Step by Step Answer:

Accounting What the Numbers Mean

ISBN: 978-1260565492

12th edition

Authors: David Marshall, Wayne McManus, Daniel Viele