Question:

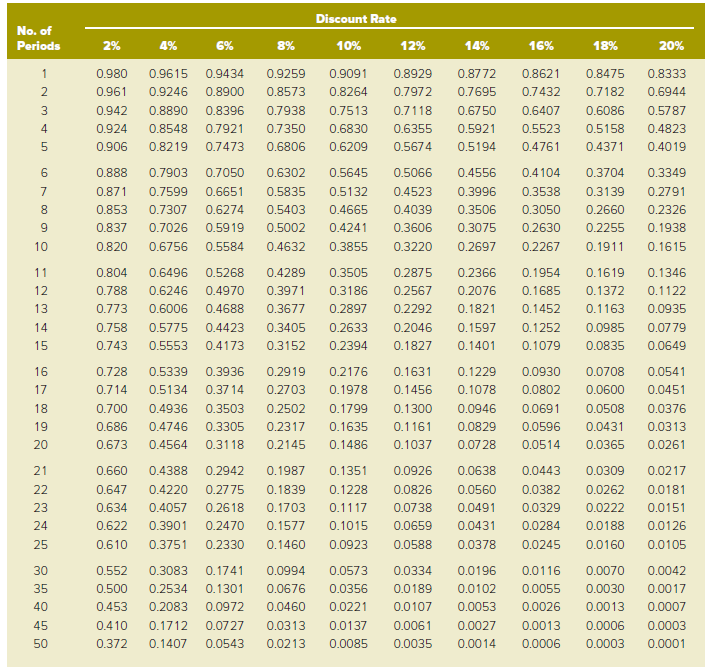

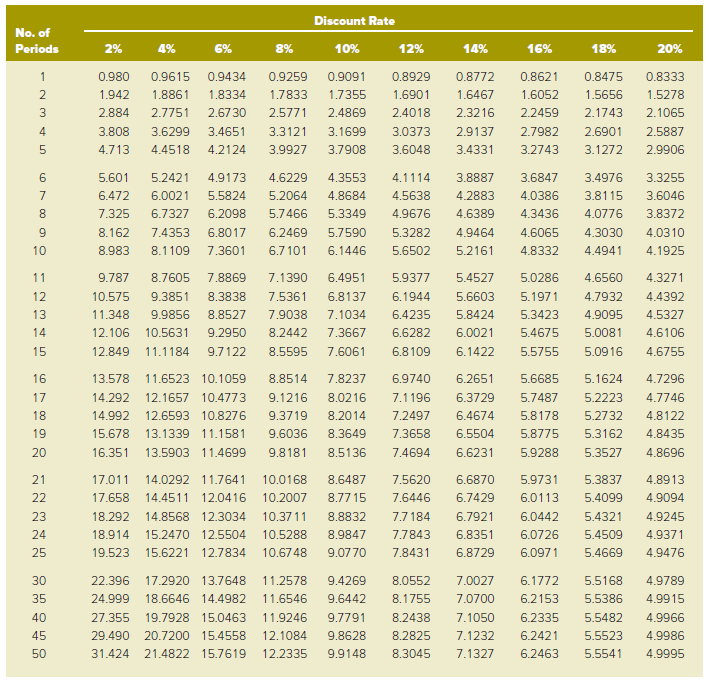

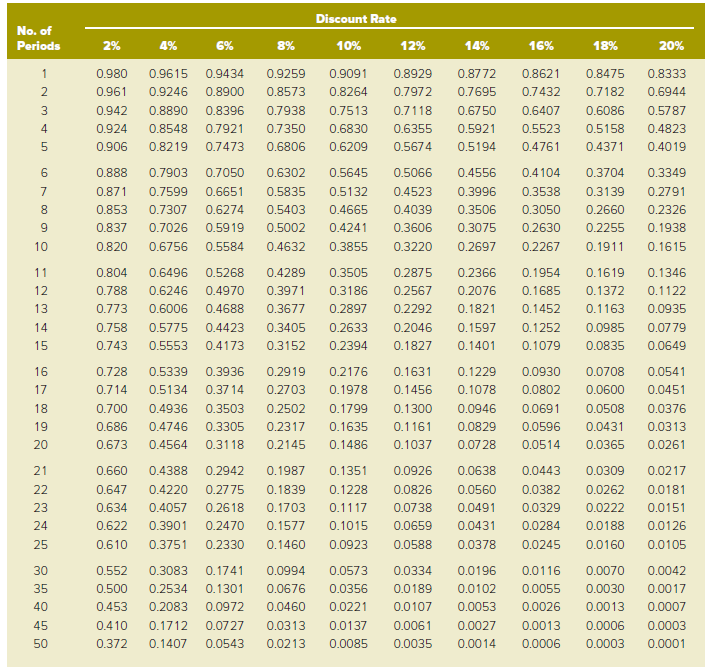

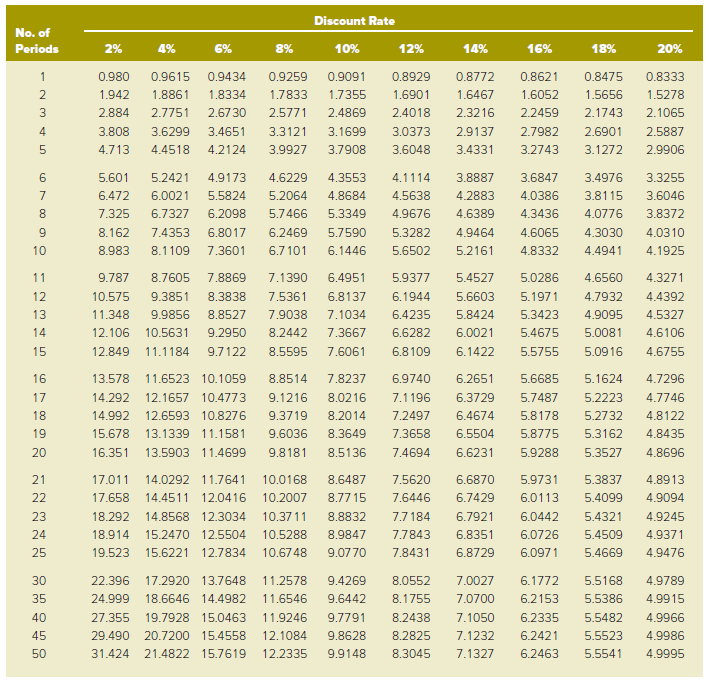

Use the appropriate factors from Table 6-4 or Table 6-5 to answer the following questions.

Required:

a. Spencer Co.?s common stock is expected to have a dividend of $5 per share for each of the next 10 years, and it is estimated that the market value per share will be $124 at the end of 10 years. If an investor requires a return on investment of 12%, what is the maximum price the investor would be willing to pay for a share of Spencer Co. common stock today?

b. Mario bought a bond with a face amount of $1,000, a stated interest rate of 8%, and a maturity date 10 years in the future for $978. The bond pays interest on an annual basis. Five years have gone by and the market interest rate is now 10%. What is the market value of the bond today?

c. Alexis purchased a U.S. Series EE savings bond for $100, and eight years later received $159.38 when the bond was redeemed. What average annual return on investment did Alexis earn over the eight years?

Table 6.4

Table 6.5

Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on...

Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Transcribed Image Text:

Discount Rate No. of 10% Periods 2% 4% 6% 8% 12% 14% 16% 18% 20% 0.980 0.8929 0.8772 0.8333 0.9615 0.9434 0.9259 0.9091 0.8621 0.8475 0.8900 2 0.961 0.9246 0.8573 0.8264 0.7972 0.7695 0.7432 0.7182 0.6944 0.942 0.8890 0.8396 0.7938 0.7513 0.7118 0.6750 0.6407 0.6086 0.5787 0.924 0.8548 0.7921 0.7350 0.6830 0.6355 0.5921 0.5523 0.5158 0.4823 0.906 0.8219 0.7473 0.6806 0.6209 0.5674 0.5194 0.4761 0.4371 0.4019 0.888 0.7903 0.7050 0.6302 0.5645 0.5066 0.4556 0.4104 0.3704 0.3349 0.871 0.7599 0.6651 0.5835 0.5132 0.4523 0.3996 0.3538 0.3139 0.2791 0.7307 0.6274 0.5403 8. 0.853 0.4665 0.4039 0.3506 0.3050 0.2660 0.2326 0.7026 0.837 0.5919 0.5002 0.4241 0.3606 0.3075 0.2630 0.2255 0.1938 0.2697 10 0.820 0.6756 0.5584 0.4632 0.3855 0.3220 0.2267 0.1911 0.1615 11 0.804 0.6496 0.5268 0.4289 0.3505 0.2875 0.2366 0.1954 0.1619 0.1346 0.6246 0.1685 12 0.788 0.4970 0.3971 0.3186 0.2567 0.2076 0.1372 0.1122 13 0.773 0.6006 0.4688 0.3677 0.2897 0.2292 0.1821 0.1452 0.1163 0.0935 0.5775 14 0.758 0.4423 0.3405 0.2633 0.2046 0.1597 0.1252 0.0985 0.0779 15 0.743 0.5553 0.4173 0.3152 0.2394 0.1827 0.1401 0.1079 0.0835 0.0649 16 0.728 0.5339 0.3936 0.2919 0.2176 0.1631 0.1229 0.0930 0.0708 0.0541 0.714 0.1456 17 0.5134 0.37 14 0.2703 0.1978 0.1078 0.0802 0.0600 0.0451 0.1300 0.0691 18 0.700 0.4936 0.3503 0.2502 0.1799 0.0946 0.0508 0.0376 0.3305 0.1635 0.1161 19 0.686 0.4746 0.2317 0.0829 0.0596 0.0431 0.0313 0.3118 20 0.673 0.4564 0.2145 0.1486 0.1037 0.0728 0.0514 0.0365 0.0261 0.1351 21 0.660 0.4388 0.2942 0.1987 0.0926 0.0638 0.0443 0.0309 0.0217 0.0826 22 0.647 0.4220 0.2775 0.1839 0.1228 0.0560 0.0382 0.0262 0.0181 23 0.634 0.4057 0.2618 0.1703 0.1117 0.0738 0.0491 0.0329 0.0222 0.0151 0.622 24 0.3901 0.2470 0.1577 0.1015 0.0659 0.0431 0.0284 0.0188 0.0126 0.610 0.3751 0.2330 0.1460 0.0378 25 0.0923 0.0588 0.0245 0.0160 0.0105 0.0116 30 0.552 0.3083 0.1741 0.0994 0.0573 0.0334 0.0196 0.0070 0.0042 0.0189 0.0030 35 0.500 0.2534 0.1301 0.0676 0.0356 0.0102 0.0055 0.0017 0.2083 0.0972 0.0460 0.0013 40 0.453 0.0221 0.0107 0.0053 0.0026 0.0007 0.0727 0.0013 45 0.410 0.1712 0.0313 0.0137 0.0061 0.0027 0.0006 0.0003 0.372 0.0035 50 0.1407 0.0543 0.0213 0.0085 0.0014 0.0006 0.0003 0.0001 LO Discount Rate No. of Periods 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 0.980 0.9615 0.9434 0.9259 0.9091 0.8929 0.8772 0.8621 0.8475 0.8333 1.942 1.8861 1.8334 1.7833 1.7355 1.6901 1.6467 1.6052 1.5656 1.5278 3 2.884 2.7751 2.6730 2.5771 2.4869 2.4018 2.3216 2.2459 2.1743 2.1065 4 3.808 3.6299 3.4651 3.3121 3.1699 3.0373 2.9137 2.7982 2.6901 2.5887 4.713 4.4518 4.2124 3.9927 3.7908 3.6048 3.4331 3.2743 3.1272 2.9906 5.601 5.2421 4.9173 4.6229 4.3553 4.1114 3.8887 3.6847 3.4976 3.3255 6.472 6.0021 5.5824 5.2064 4.8684 4.5638 4.2883 4.0386 3.8115 3.6046 8. 7.325 6.7327 6.2098 5.7466 5.3349 4.9676 4.6389 4.3436 4.0776 3.8372 8.162 7.4353 6.8017 6.2469 5.7590 5.3282 4.9464 4.6065 4.3030 4.0310 10 8.983 8.1109 7.3601 6.7 101 6.1446 5.6502 5.2161 4.8332 4.4941 4.1925 11 9.787 8.7605 7.8869 7.1390 6.4951 5.9377 5.4527 5.0286 4.6560 4.3271 12 10.575 9.3851 8.3838 7.5361 6.8137 6.1944 5.6603 5.1971 4.7932 4.4392 13 11.348 9.9856 8.8527 7.9038 7.1034 6.4235 5.8424 5.3423 4.9095 4.5327 14 12.106 10.5631 9.2950 8.2442 7.3667 6.6282 6.0021 5.4675 5.0081 4.6106 15 12.849 11.1184 9.7122 8.5595 7.6061 6.8109 6.1422 5.5755 5.0916 4.6755 16 13.578 11.6523 10.1059 8.8514 7.8237 6.9740 6.2651 5.6685 5.1624 4.7296 17 14.292 12.1657 10.4773 9.1216 8.0216 7.1196 6.3729 5.7487 5.2223 4.7746 18 14.992 12.6593 10.8276 9.3719 8.2014 7.2497 6.4674 5.8178 5.2732 4.8122 19 15.678 13.1339 11.1581 9.6036 8.3649 7.3658 6.5504 5.8775 5.3162 4.8435 20 16.351 13.5903 11.4699 9.8181 8.5136 7.4694 6.6231 5.9288 5.3527 4.8696 21 17.011 14.0292 11.7641 10.0168 8.6487 7.5620 6.6870 5.9731 5.3837 4.8913 22 17.658 14.4511 12.0416 10.2007 8.77 15 7.6446 6.7429 6.0113 5.4099 4.9094 23 18.292 14.8568 12.3034 10.3711 8.8832 7.7 184 6.7921 6.0442 5.4321 4.9245 24 18.914 15.2470 12.5504 10.5288 8.9847 7.7843 6.8351 6.0726 5.4509 4.9371 25 19.523 15.6221 12.7834 10.6748 9.07 70 7.8431 6.8729 6.0971 5.4669 4.9476 30 22.396 17.2920 13.7648 11.2578 9.4269 8.0552 7.0027 6.1772 5.5168 4.9789 35 24.999 18.6646 14.4982 11.6546 9.6442 8.1755 7.0700 6.2153 5.5386 4.9915 40 27.355 19.7928 15.0463 11.9246 9.7791 8.2438 7.1050 6.2335 5.5482 4.9966 45 29.490 20.7200 15.4558 12.1084 9.8628 8.2825 7.1232 6.2421 5.5523 4.9986 50 31.424 21.4822 15.7619 12.2335 9.9148 8.3045 7.1327 6.2463 5.5541 4.9995