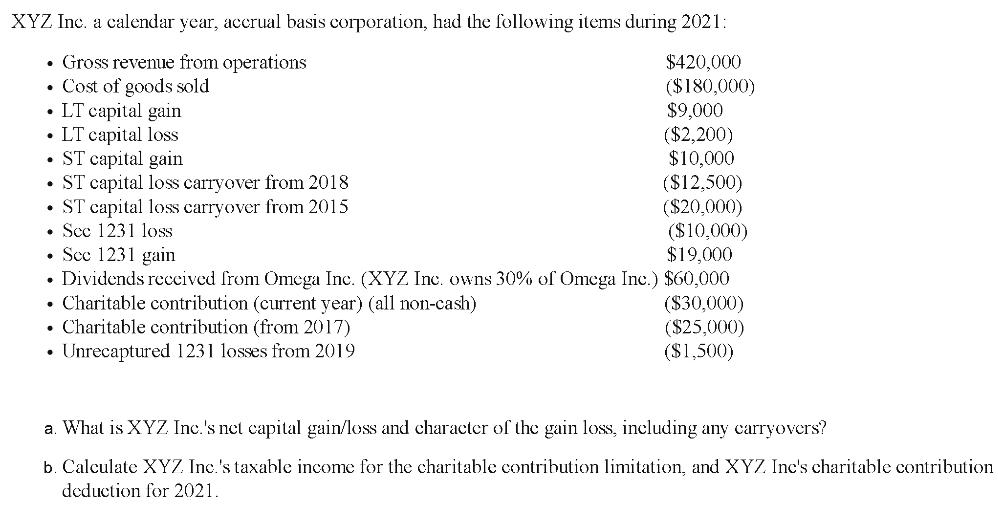

XYZ Inc. a calendar year, accrual basis corporation, had the following items during 2021: Gross revenue from operations Cost of goods sold $420,000 ($180,000)

XYZ Inc. a calendar year, accrual basis corporation, had the following items during 2021: Gross revenue from operations Cost of goods sold $420,000 ($180,000) $9,000 LT capital gain .LT capital loss ($2,200) ST capital gain $10,000 ST capital loss carryover from 2018 ($12,500) ($20,000) ($10,000) Scc 1231 gain $19,000 Dividends received from Omega Inc. (XYZ Inc. owns 30% of Omega Inc.) $60,000 Charitable contribution (current year) (all non-cash) Charitable contribution (from 2017) ($30,000) ($25,000) ($1,500) Unrecaptured 1231 losses from 2019 . ST capital loss carryover from 2015 . Sec 1231 loss . . a. What is XYZ Inc.'s net capital gain/loss and character of the gain loss, including any carryovers? b. Calculate XYZ Inc.'s taxable income for the charitable contribution limitation, and XYZ Inc's charitable contribution deduction for 2021.

Step by Step Solution

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Gross capital gain 60000 Less capital losses 30000 Net capital gain 30000 Ch... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards