1. According to FASB 133, which of the following is not an underlying? a. A security price....

Question:

1. According to FASB 133, which of the following is not an underlying?

a. A security price.

b. A monthly average temperature.

c. The price of a barrel of oil.

d. The number of foreign currency units.

2. The intrinsic value of a cash-flow hedge has increased since the last balance sheet date. Which of the following accounting treatments is appropriate for this increase in value?

a. Do not record the increase in the value because it has not been realized in an exchange transaction.

b. Record the increase in value to current earnings.

c. Record the increase to other comprehensive income.

d. Record the increase in a deferred income account.

3. The requirements for a derivative instrument include all but which of the following?

a. Has one or more underlyings.

b. Has one or more notional amounts.

c. Requires an initial net investment equal to that required for other types of contracts that would be expected to have a similar response to changes in market factors.

d. Requires or permits net settlement.

4. A decrease in the intrinsic value of a fair-value hedge are accounted for as:

a. A decrease of current earnings.

b. Not recorded because the exchange transaction has not yet occurred.

c. A decrease of other comprehensive income.

d. A liability to be offset with subsequent increases in the fair value of the hedge.

5. Changes in the fair value of the effective portion of a hedging financial instrument are recognized as a part of current earnings of the period for which of the following:

1. According to FASB 133, which of the following is not an underlying?

a. A security price.

b. A monthly average temperature.

c. The price of a barrel of oil.

d. The number of foreign currency units.

2. The intrinsic value of a cash-flow hedge has increased since the last balance sheet date. Which of the following accounting treatments is appropriate for this increase in value?

a. Do not record the increase in the value because it has not been realized in an exchange transaction.

b. Record the increase in value to current earnings.

c. Record the increase to other comprehensive income.

d. Record the increase in a deferred income account.

3. The requirements for a derivative instrument include all but which of the following?

a. Has one or more underlyings.

b. Has one or more notional amounts.

c. Requires an initial net investment equal to that required for other types of contracts that would be expected to have a similar response to changes in market factors.

d. Requires or permits net settlement.

4. A decrease in the intrinsic value of a fair-value hedge are accounted for as:

a. A decrease of current earnings.

b. Not recorded because the exchange transaction has not yet occurred.

c. A decrease of other comprehensive income.

d. A liability to be offset with subsequent increases in the fair value of the hedge.

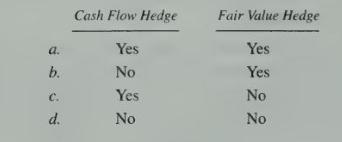

5. Changes in the fair value of the effective portion of a hedging financial instrument are recognized as a part of current earnings of the period for which of the following:

6. According to FASB 133, for which of the following is hedge accounting not allowed?

a. A forecasted purchase or sale.

b. Available-for-sale securities.

c. Trading securities.

d. An unrecognized firm commitment.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King