(a) Newton plc, to whom you are financial adviser, is preparing its financial statements for the year...

Question:

(a) Newton plc, to whom you are financial adviser, is preparing its financial statements for the year ended 31 March 1992. It has two wholly owned subsidiaries:

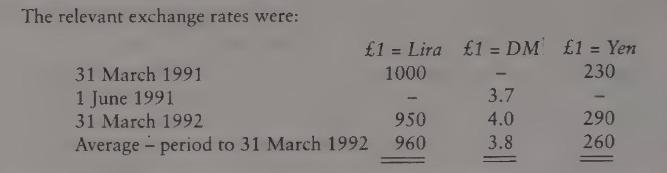

- An Italian company, Darwin SpA, which it acquired a number of years ago at a cost of \(500 \mathrm{~m}\) Lira. Newton plc incorporates the financial statements of Darwin \(\mathrm{SpA}\) in its consolidated financial statements using the closing rate method. During 1989, Newton plc borrowed 1000 million Lira (repayable in 1999) to provide a hedge against the investment, which was then considered to be worth in excess of 1500 million Lira. The net assets of Darwin SpA at 31 March 1991 were 1200 million Lira.

- A German company, Hoyle GmbH, which it set up on 1 June 1991 at a cost of Dm 25 million. Newton plc is to incorporate Hoyle \(\mathrm{GmbH}\) in its consolidated financial statements using the temporal method. The exchange loss for the period is \(£ 52000\). Newton plc partially financed the acquisition of the shares by borrowing Dm 20m repayable in 1997.

In addition, Newton plc has a \(15 \%\) investment in a Japanese company, Gamow Inc, which it acquired in 1980 at a cost of Yen 220 million, financed by means of a Yen loan of the same amount. At 31 March 1992 none of the loan had been repaid.

(b) The directors of Newton plc have asked your advice in respect of the following.

For sound commercial reasons Darwin \(\mathrm{SpA}\) is to change its year end to 31 January with effect from 31 January 1993. The consolidated financial statements will hence forward include results for Darwin SpA drawn up for the period to 31 January. The directors wonder which 'closing exchange rate' to use for the purposes of the 31 March 1993 financial statements for the Newton plc group - that at 31 January 1993 or that at 31 March 1993.

\section*{Required}

(a) For the year ended 31 March 1992 calculate, in accordance with standard accounting practice, the exchange differences in respect of the investments/borrowings in

(a) above and explain the treatment thereof in both the company and the consolidated financial statements for Newton plc.

(11 marks)

(b) Prepare a paper advising the directors of Newton plc as to the accounting considerations to be taken into account in connection with Darwin SpA's change of year end; advise the directors of any appropriate accounting treatments for the purposes of the consolidated financial statements.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780273638339

6th Edition

Authors: Richard Lewis, David Pendrill