Andover Corporation acquired 65 percent of the ownership of Chad Company on January 1, 20X6, at underlying

Question:

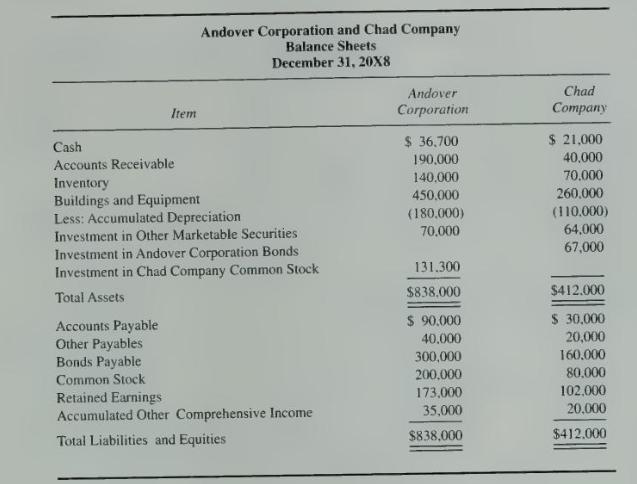

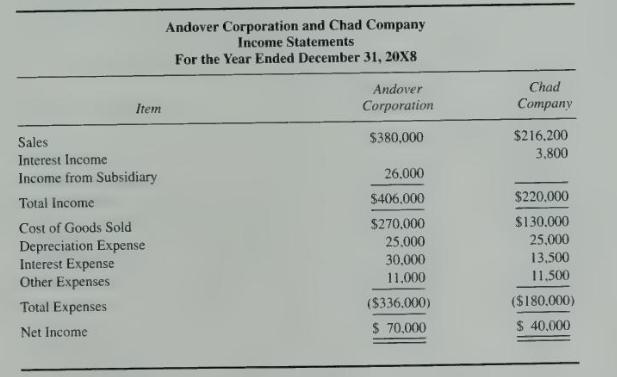

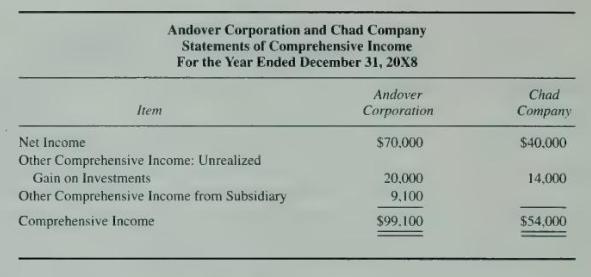

Andover Corporation acquired 65 percent of the ownership of Chad Company on January 1, 20X6, at underlying book value. Financial statements for the two companies at December 31, 20X8, are as follows:

Andover and Chad paid dividends of \(\$ 45,000\) and \(\$ 28,000\), respectively, in \(20 \times 8\).

On July 1, 20X8. Chad purchased \(\$ 70,000\) of Andover bonds from nonaffiliates for \(\$ 66,700\). The bonds pay 10 percent interest annually on December 31 and were issued on January 1, 20X4, to mature in 10 years. Chad uses straight-line write-off of the bond discount.

Andover purchased inventory costing \(\$ 60,000\) and \(\$ 96,000\) from Chad during 20X7 and 20X8, respectively. Chad prices its products at cost plus a 50 percent markup on cost. Andover held \(\$ 18,000\) of inventory purchased from Chad at December 31, 20X7. These purchases were sold in 20X8, along with \(\$ 63,000\) of inventory purchased from Chad in 20X8.

Both Andover and Chad have investments classified as available-for-sale that have increased in value since acquisition. Securities owned by Andover increased in value \(\$ 2,000\) in 20X7 and \(\$ 20,000\) in 20X8, while those held by Chad increased by \(\$ 6,000\) in \(20 \times 7\) and \(\$ 14,000\) in \(20 \times 8\).

\section*{Required}

a. Prepare the journal entries recorded by Andover during 20X8 for its investment in Chad Company's common stock.

b. Prepare the eliminating entries needed at December 31, 20X8, to complete a consolidation workpaper for Andover and Chad.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King