Apex Corporation acquired 75 percent of the common stock of Beta Company on May 15, 20X3, at

Question:

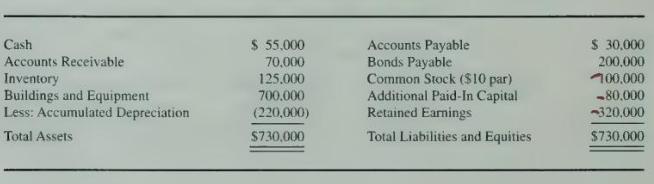

Apex Corporation acquired 75 percent of the common stock of Beta Company on May 15, 20X3, at underlying book value. The balance sheet of Beta Company on December 31, 20X6, contained the following amounts:

During 20X7. Apex earned operating income of \(\$ 90,000\), and Beta reported net income of \(\$ 45,000\). Neither company declared any dividends during \(20 \times 7\).

Beta Company is considering repurchasing 1,000 of its outstanding shares as treasury stock at a price of \(\$ 68\) each.

\section*{Required}

a. Assuming the shares are purchased from Nonaffiliated Company on January 1, 20X7:

(1) Compute the effect on the book value of the shares held by Apex Corporation.

(2) Give the entry on the books of Apex Corporation to record the change in the book value of its investment in Beta's shares.

(3) Prepare the eliminating entries needed on December \(31,20 \times 7\), to complete a consolidation workpaper.

b. Assuming the shares are purchased directly from Apex Corporation on January 1, 20X7:

(1) Compute the effect on the book value of the shares held by Apex Corporation.

(2) Give the entry on the books of Apex Corporation to record its sale of Beta Corporation shares to Beta.

(3) Prepare the eliminating entries needed on December \(31,20 \times 7\), to complete a consolidation workpaper.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King