Penn Corporation purchased 80 percent ownership of ENC Company on January 1, 20X2, at underlying book value.

Question:

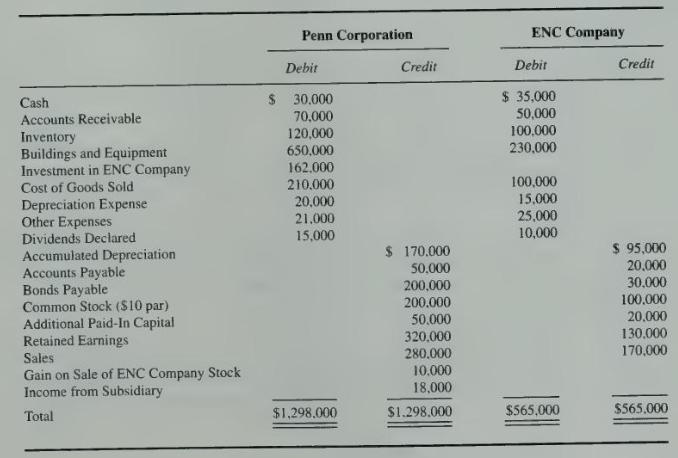

Penn Corporation purchased 80 percent ownership of ENC Company on January 1, 20X2, at underlying book value. On January 1, 20X4, Penn Corporation sold 2,000 shares of ENC Company stock for \(\$ 60,000\) to American School Products. Trial balances for the companies on December 31, \(20 \times 4\), contain the following data:

ENC Company net income was earned evenly throughout the year. Both companies declared and paid their dividends on December 31, 20X4. Penn Corporation uses the basic equity method in accounting for its investment in ENC Company.

\section*{Required}

a. Prepare the elimination entries needed to complete a full consolidation workpaper for \(20 \mathrm{X} 4\).

b. Prepare a consolidation workpaper for 20X4.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King