Baxter Industries, Inc., is a U.S. company that has a wholly owned subsidiary. The subsidiary maintains its

Question:

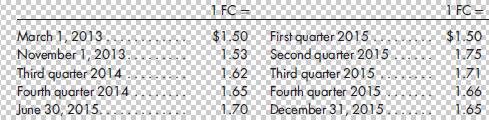

Baxter Industries, Inc., is a U.S. company that has a wholly owned subsidiary. The subsidiary maintains its book and records in a foreign currency (FC) and the majority of its local expenses such as payroll, utilities, rent, etc., are paid in FC. However, the U.S. dollar is considered to be its functional currency. Selected exchange rates are as follows:

1. Identify several specific factors that would suggest that the U.S. dollar is the functional currency in spite of the fact regarding local expenses.

2. For each of the following compute the remeasured amount to be included as a component of the subsidiary’s net income measured in its functional currency.

a. Cost of sales for Product A is based on the FIFO method, and 6,200 units were sold during the current year 2015. The 2014 ending inventory consisted of 1,300 units purchased as follows: 400 units purchased at a cost of 53 FC per unit throughout the third quarter of 2014 and 900 units purchased at a cost of 55 FC per unit throughout the fourth quarter of 2014. Purchases during the year 2015 were as follows: 1,200 units at a cost of 58 FC per unit throughout the first quarter, 3,000 units at a cost of 59 FC per unit throughout the third quarter, and 1,700 units at a cost of 57 FC per unit throughout the fourth quarter. Determine the 2015 cost of sales for Product A.

b. Equipment is depreciated over a 10-year life using the straight-line method of depreciation. Equipment was purchased at the beginning of March and November of 2013 in the amounts of 360,000 FC and 120,000 FC, respectively. Determine the 2015 depreciation expense.

c. Also, on March 1, 2013, the subsidiary acquired a patent for $108,000. At that time, it was estimated that the patent would have a useful life of 12 years. At June 30, 2015, the value of the patent became impaired, and the subsidiary reclassified the assets as ‘‘held for resale’’ and carried the asset at its net realizable value of 32,000 FC. Determine the 2015 amortization expense and impairment loss associated with the patent.

d. On June 30, 2015, the subsidiary borrowed 10,000 foreign currency A (FCA) from a foreign bank when 1 FCA was equal to 1.20 FC. Interest accrues semiannually at the annual rate of 6%, and the principal and accrued interest are due on June 30, 2016. At year-end 2015, 1 FCA was equal to 1.24 FC. Determine the effect on 2015 remeasured income as a result of this transaction.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng