Belle Valley incurred $100,000 of salaries and wages for the month ended March 31, 20X2. How should

Question:

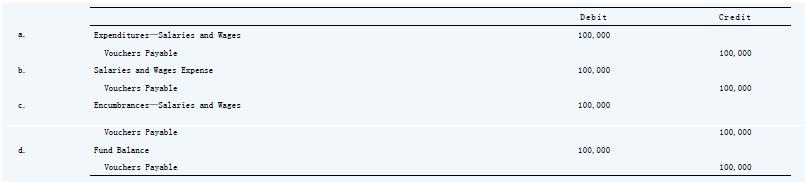

Belle Valley incurred $100,000 of salaries and wages for the month ended March 31, 20X2. How should this be recorded on that date?

Transcribed Image Text:

c. Expenditures Salaries and Wages Debit Vouchers Payable Salaries and Vages Expense Vouchers Payable Encumbrances Salaries and Wages Vouchers Payable d. Fund Balance Vouchers Payable Credit 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Branice Buyengo Ajevi

I have been teaching for the last 5 years which has strengthened my interaction with students of different level.

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Advanced Financial Accounting

ISBN: 9781260165111

12th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd

Question Posted:

Students also viewed these Business questions

-

Select the correct answer for each of the following questions. 1. One difference between accounting for a governmental (not-for-profit) unit and a commercial (for-profit) enterprise is that a...

-

You have recently been appointed as the accountant of CHIPPIE CHIP, a registered VAT vendor that sells potato chips to various entities across the Western Cape. The business was started 11 months...

-

The transactions below appeared in the books of Fidel Fertiliser Company. Fidel set up the business to sell the latest grass fertiliser that ensures that grass stays green all year round. Fidel...

-

An investor has $60,000 to invest in a $280,000 property. He can obtain either a $220,000 loan at 9.5 percent for 20 years or a $180,000 loan at 9 percent for 20 years and a second mortgage for...

-

Identify two decisions at the organizations described in this case that were improved by using big data and two decisions that big data did not improve.

-

Which of the following events would be recognized and recorded in the accounting records of the Friese Corporation on the date indicated? Jan. 15 Friese Corporation offers to purchase a tract of land...

-

11 Describa un lineamiento de autorregulacin que usted crea que mejorara el valor de a) una forma existente de promocin y b) una nueva prctica promocional.

-

At the market close on October 27 of a recent year, McDonalds Corporation had a closing stock price of $93.49. In addition, McDonalds Corporation had a dividend per share of $2.44 during the previous...

-

URGENT Mason Engineering manufactures audio devices for cars and uses job order costing. There are two departments. In Department A, overhead is applied on the basis of machine-hours, and in...

-

Which of the following accounts of a governmental unit is credited when taxpayers are billed for property taxes? a. Estimated Revenue. b. Revenue. c. Appropriations. d. Fund BalanceAssigned for...

-

One difference between accounting for a governmental (not-for-profit) unit and a commercial (for-profit) enterprise is that a governmental unit should a. Not record depreciation expense in any of its...

-

Different types of legal arrangements that can take place to create abusinesscombination.

-

Molina Company produces three products: A130, B324, and C587 All three products use the same direct material, Brac Unt data for the three products are in the provided table. (Click to view the unit...

-

MFGE 437 S21 - Homework 1 Submissions will be Online! Please scan your HWs and upload on Canvas Problem 1: A vertical milling machine is to be retrofitted with three identical DC servo motors. The...

-

On January 1, Palisades, Inc., acquired 100 percent of Sherwood Company's common stock for a fair value of $120,340,000 in cash and stock. The carrying amounts of Sherwood's assets and liabilities...

-

(1) A test balloon has an accelerometer attached to it. After you release it and start collecting data it is 5 ft in front of you and 16 ft above you, and it is moving 5 ft/s to your left and 4 ft/s...

-

484 ... Age of Accounts as of June 30, 2019 1-30 31-60 61-90 Over 90 Customer Name Days Days Days Days Total Balance Canyon Youth Club $ 250 $ 250 Crazy Tees 200 $ 150 350 Early Start Daycare $500...

-

Readers, Inc., an online bookstore, had the following account balances at year- end: Sales Revenue of $ 420,000; Cost of Goods Sold of $ 240,000; Salary Expense of $ 120,000; Insurance Expense of $...

-

Why do CPA firms sometimes use a combination of positive and negative confirmations on the same audit?

-

Partners Maness and Joiner have decided to liquidate their business. The ledger shows the following account balances: Maness and Joiner share profits and losses in an 8:2 ratio. During the first...

-

Nelson, Osman, Peters, and Quincy have decided to terminate their partnership because of recurrent arguments among the partners. The partnerships balance sheet when they decide to wind up follows:...

-

Nelson, Osman, Peters, and Quincy have decided to terminate their partnership because of recurrent arguments among the partners. The partnerships balance sheet when they decide to wind up follows:...

-

Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the production of various paper goods. Revenue and costs associated with a ton of pulp follow: Selling...

-

The AICPA guidelines suggest that taxes should be transparent and visible. This means that: a. The taxes affect similarly situated taxpayers in a similar manner. b. Taxes should be due at the same...

-

What is Apple Companys strategy for success in the marketplace? Does the company rely primarily on customer intimacy, operational excellence, or product leadership? What evidence supports your...

Study smarter with the SolutionInn App