Bilge Pumpworks and Seaworthy Rope Company agreed to merge on January 1, 20X3. On the date of

Question:

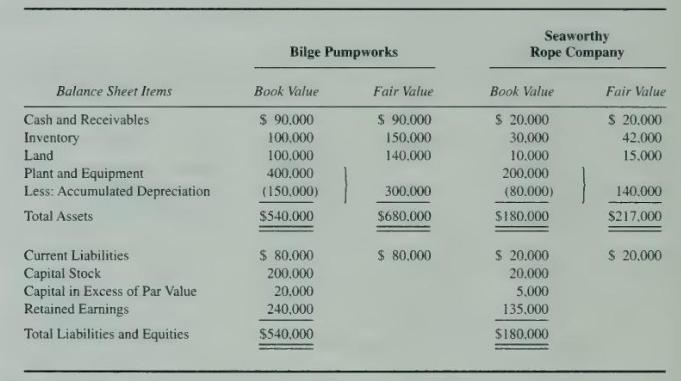

Bilge Pumpworks and Seaworthy Rope Company agreed to merge on January 1, 20X3. On the date of the merger agreement, the companies report the following data:

Bilge Pumpworks has 10,000 shares of its \(\$ 20\) par value shares outstanding on January 1, 20X3, and Seaworthy has 4,000 shares of \(\$ 5\) par value stock outstanding. The market values of the shares are \(\$ 300\) and \(\$ 50\), respectively.

\section*{Required}

a. Bilge issues 700 shares of stock in exchange for all the net assets of Seaworthy. Prepare a balance sheet for the combined entity immediately following the merger assuming the acquisition is recorded as a purchase.

b. Prepare the stockholders' equity section of the combined company's balance sheet under purchase treatment assuming Bilge acquires all the net assets of Seaworthy by issuing:

(1) 1,100 shares of common.

(2) 1,800 shares of common.

(3) 3,000 shares of common.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King