Use the data presented in Problem 1-28 to do the following: a. Prepare a balance sheet for

Question:

Use the data presented in Problem 1-28 to do the following:

a. Prepare a balance sheet for the combined entity immediately following the merger assuming Bilge Pumpworks issues 700 shares of its stock in exchange for the net assets of Seaworthy in a business combination recorded as a pooling of interests.

b. Prepare the stockholders' equity section of the combined balance sheet under pooling of interests treatment assuming Bilge acquires all of the net assets of Seaworthy by issuing the following shares:

(1) 1,100 shares of common.

(2) 1,800 shares of common.

(3) 3,000 shares of common.

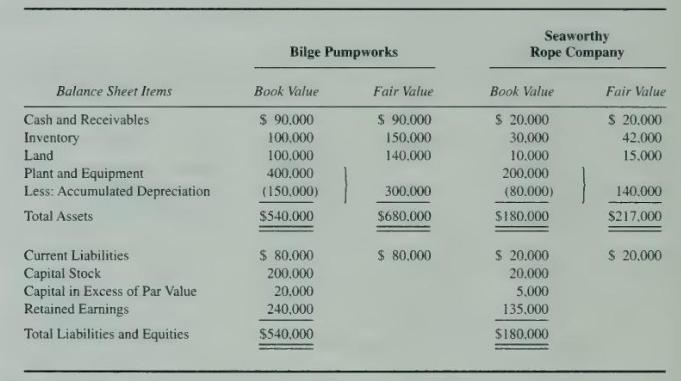

Data From Problem 1-28 Bilge Pumpworks and Seaworthy Rope Company agreed to merge on January 1, 20X3. On the date of the merger agreement, the companies report the following data:

Bilge Pumpworks has 10,000 shares of its \(\$ 20\) par value shares outstanding on January 1, 20X3, and Seaworthy has 4,000 shares of \(\$ 5\) par value stock outstanding. The market values of the shares are \(\$ 300\) and \(\$ 50\), respectively.

\section*{Required}

a. Bilge issues 700 shares of stock in exchange for all the net assets of Seaworthy. Prepare a balance sheet for the combined entity immediately following the merger assuming the acquisition is recorded as a purchase.

b. Prepare the stockholders' equity section of the combined company's balance sheet under purchase treatment assuming Bilge acquires all the net assets of Seaworthy by issuing:

(1) 1,100 shares of common.

(2) 1,800 shares of common.

(3) 3,000 shares of common.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King