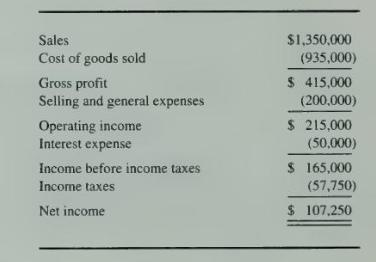

Burnell Inc. reported the following income statement for the quarter ended March 31, 20X5: The following events

Question:

Burnell Inc. reported the following income statement for the quarter ended March 31, 20X5:

The following events occurred during the second quarter:

1. Burnell warranties its products for one year after sale. The company has accrued warranty expense at the rate of 3 percent of sales, and \(\$ 40,500\) of warranty expense was included in the selling and general expenses of the first quarter. However, at June 30, 20X5, Burnell decided to decrease the percentage to 2 percent of sales.

2. On June 30, 20X5, Burnell decided to switch from the sum-of-the-years'-digits method of depreciation to the straight-line method for all of its delivery equipment. The company acquired all of its delivery equipment in January of \(20 \mathrm{X} 1\) at a cost of \(\$ 240,000\). The useful life of the delivery equipment was estimated to be 10 years, and the salvage value was estimated to be \(\$ 20,000\). Included in selling and general expenses for the quarter ended March \(31,20 \times 5\), is \(\$ 6,000\) of depreciation expense related to the delivery equipment.

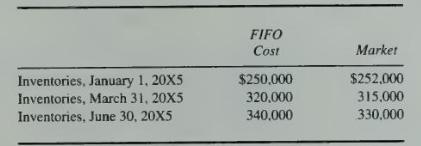

3. Burnell uses the FIFO method for its inventories and reports its inventories on the balance sheet at the lower of FIFO cost or market. Inventory and cost of goods manufactured information for the first two quarters is presented below:

The company's cost of goods manufactured for the first quarter was \(\$ 1,005,000\), while the cost of goods manufactured during the second quarter amounted to \(\$ 1,100,000\). Burnell's management believes that the reductions in the market values of the inventories at the end of the first two quarters were temporary and will be restored by the end of 20X5.

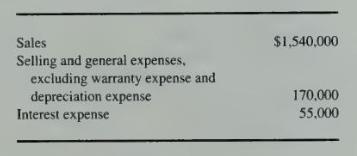

4. Burnell had the following operating information for the second quarter:

5. The estimated annual effective tax rate determined at the end of the second quarter is 32 percent. The same rate applies to the cumulative effect resulting from the change in depreciation methods.

\section*{Required}

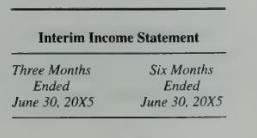

a. Prepare Burnell's interim income statement for the six months and for the three months ending on June 30, 20X5. Show all of your supporting computations in good form. You should present the income statements using the following headings:

b. What would cost of goods sold have been for the second quarter if Burnell's management thought the market declines in its ending inventories for the first two quarters were permanent? Assume the iosses due to market declines are included in cost of goods sold.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King