Candy, Davis, and Evans, who are accountants, agreed to combine their individual practices into a partnership as

Question:

Candy, Davis, and Evans, who are accountants, agreed to combine their individual practices into a partnership as of January 1,20X3. The partnership includes the following features.

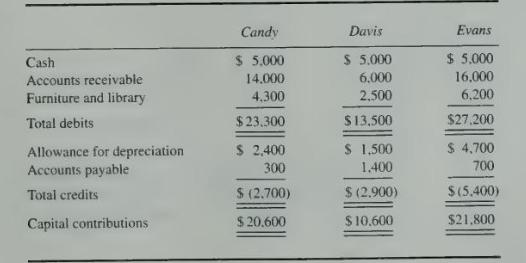

1. Each partner's capital contribution was the net amount of assets and liabilities taken over by the partnership, which were as follows:

Each partner guaranteed the collectibility of receivables.

2. Evans leased office space and was bound by the lease until June \(30,20 \times 3\). The monthly rental was \(\$ 600\). The partners agreed to occupy Evans's office space until the expiration of the lease

and to pay the rent. The partners concurred that the rent was too high for the space and that a fair rental value is \(\$ 450\) per month. The excess rent is to be charged to Evans at year-end. On July I, the partners moved to new quarters with a monthly rental of \(\$ 500\).

3. No salaries are to be paid to the partners. The individual partners are to receive 20 percent of the gross fees billed to their respective clients during the first year of the partnership. After deducting operating expenses (excluding the excess rent), the residual profit should be credited to the partners' capital accounts in the following ratios: Candy, 40 percent; Davis, 35 percent; Evans, 25 percent.

4. On April 1, 20X3, Flint was admitted to the partnership. Flint is to receive 20 percent of the fees from new business obtained after April 1, after deducting expenses applicable to that new business. Expenses (excluding the excess rent) are to be apportioned to the new business in the same ratio that total expenses for the entire year, other than bad debt losses, bore to total gross fees.

5. The following information pertains to the partnership's activities in \(20 \times 3\).

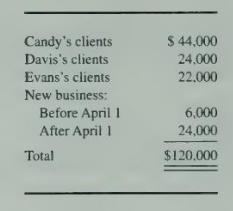

a. Fees were billed as follows:

b. Total expenses, excluding depreciation and uncollectible accounts expenses, were \(\$ 29,350\), including the total amount paid for rent. Depreciation is to be computed at the rate of 10 percent of the original cost of the furniture and library for each partner. Depreciable assets purchased during \(20 \mathrm{X} 3\), on which half a year's depreciation is to be taken, totaled \(\$ 5,000\).

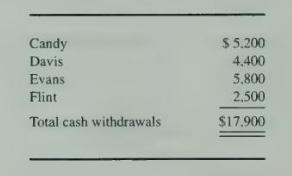

c. Cash withdrawals charged to the partners' accounts during the year were:

d. Of Candy's and Davis's receivables, \(\$ 1,200\) and \(\$ 450\), respectively, proved to be uncollectible and were charged against their capital accounts. A new client billed in March for \(\$ 1.600\) had been adjudged bankrupt, and a settlement of 50 cents on the dollar was made.

\section*{Required}

a. Determine the profit for 20X3.

b. Prepare a schedule showing how the profit for \(20 \times 3\) is to be divided.

c. Prepare a statement of partners' capital for the year ended December 31, 20X3.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King