The Glidden Manufacturing Company was organized as a partnership by Howard and Pat on January 1, 20X7,

Question:

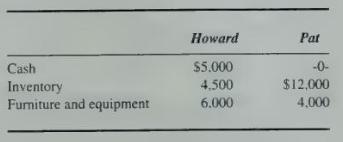

The Glidden Manufacturing Company was organized as a partnership by Howard and Pat on January 1, 20X7, and has operated for one year. At the time the partnership was formed, Howard and Pat made the following investments:

Howard and Pat share profits and losses equally. On December 31, 20X7, they invite Mary into the partnership for a one-third interest. Mary asks for an examination of the partnership's accounting records prior to her investment, and you are hired to do the examination. During your review, you discover the following as of December 31, 20X7.

1. A part-time bookkeeper for the company had thrown away all cash register tapes and invoices for expenses and purchases.

2. In reviewing the reported accounts payable of \(\$ 3,200\), you discover that an additional amount of \(\$ 3,000\) due to creditors for inventory purchases has not been recorded.

3. The bookkeeper had incorrectly recorded \(\$ 4,500\) of cash received from partner Howard in June \(20 \times 7\) as an increase in investment when, in actuality, the partners had agreed that the transaction was a loan from Howard to the partnership. No interest was recorded on the loan, and you determine that interest of \(\$ 200\) should have been accrued and recorded for the loan payable.

4. Your analysis of accounts receivable of \(\$ 4,300\) showed that additional sales of \(\$ 1,000\) had not been recorded. The \(\$ 1,000\) in unreported sales were made on credit and remained uncollected as of December 31, 20X7.

5. Depreciation was not recorded for the year. You determine that depreciation expense on the equipment should have been \(\$ 800\).

6. Your physical count of inventory showed that ending inventory was \(\$ 6,000\).

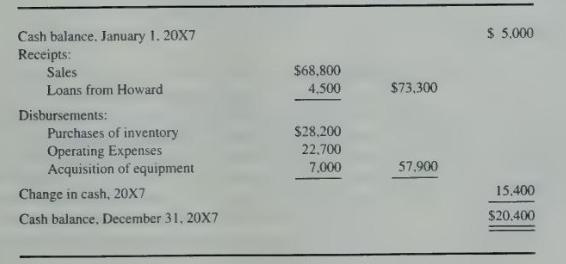

7. You prepare the following summary of cash transactions from bank statements and canceled checks:

8. After all the corrections are posted, the partners and Mary agree that she should contribute \(\$ 20,000\) for her one-third interest. The bonus method will be used to account for the admission of Mary, and all profits and losses are to be shared equally among the three partners.

\section*{Required}

a. Prepare a corrected income statement for the partnership for \(20 \mathrm{X} 7\).

b. Prepare a statement of partners' capital for the year 20X7.

c. Prepare the journal entry to record the admission of Mary into the partnership as of December \(31,20 \times 7\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King