Chocolate De-lites imports and exports chocolate delicacies. Some transactions are denominated in U.S. dollars and others in

Question:

Chocolate De-lites imports and exports chocolate delicacies. Some transactions are denominated in U.S. dollars and others in foreign currencies. A summary of accounts receivable and accounts payable on December 31, 20X6, before adjustments for the effects of changes in exchange rates during 20X6, follows:

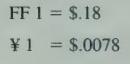

The spot rates on December 31, 20X6, were:

The average exchange rates during the collection and payment period in 20X7 are:

\section*{Required}

a. Prepare the adjusting entries on December 31, 20X6.

b. Record the collection of the accounts receivable in 20X7.

c. Record the payment of the accounts payable in \(20 \times 7\).

d. What was the foreign currency gain or loss on the accounts receivable transaction denominated in FF for the year ended December 31, 20X6? For the year ended December 31, 20X7? Overall for this transaction?

e. What was the foreign currency gain or loss on the accounts receivable transaction denominated in \(¥\) ? For the year ended December 31, 20X6? For the year ended December 31, 20X7? Overall for this transaction?

f. What was the combined foreign currency gain or loss for both transactions? What could Chocolate De-lites have done to reduce the risk associated with the transactions denominated in foreign currencies?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King