Company X seeks your assistance to determine its tax expense under IAS 12 Income Taxes. The accountant

Question:

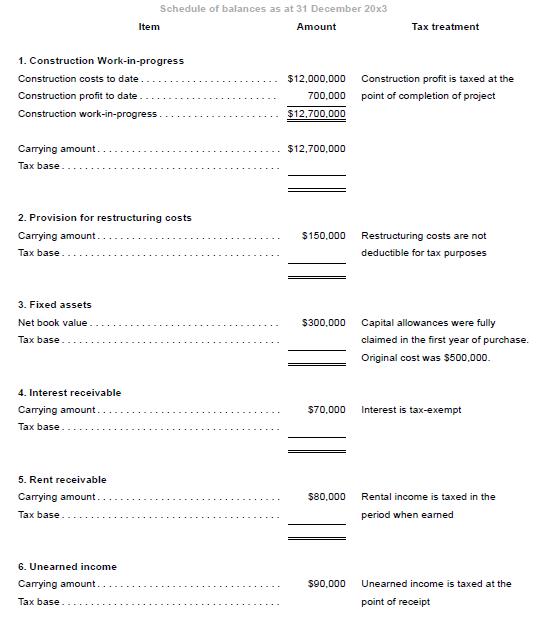

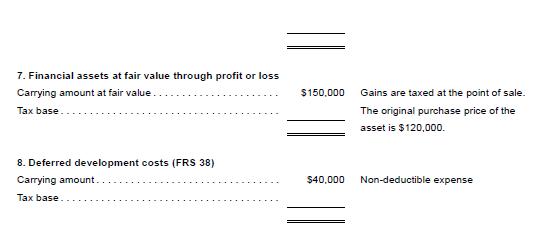

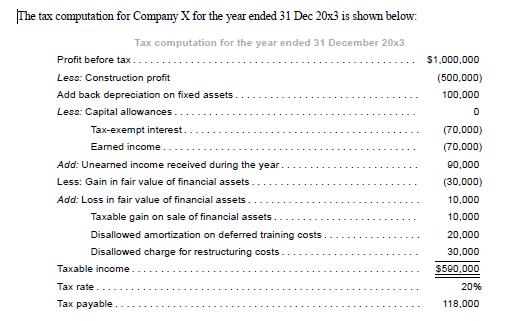

Company X seeks your assistance to determine its tax expense under IAS 12 Income Taxes. The accountant has provided you with a schedule below of carrying amounts of assets and liabilities and information relating to the tax treatments of the items. The accountant also provided the tax computation for the financial year ended 31 December 20x3. Complete the schedule. Indicate clearly whether a taxable or deductible temporary difference exists for each item. If the temporary difference is not to be recognized under IAS 12, state clearly.

Required

1. Determine the tax expense of Company X for the year ended 31 December 20x3. Tax rate for 20x2 is 22%.

Prepare the journal entry.

2. Perform an analytical check of the tax expense.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah