You have been assigned to prepare the deferred tax computations for Co A for the years ended

Question:

You have been assigned to prepare the deferred tax computations for Co A for the years ended 31 December 20x2 and 20x3. The following details relate to Co A’s assets and liabilities.

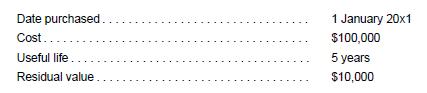

(a) Fixed assets

Depreciation is on a straight line basis. Capital allowances of $100,000 are claimed in full in 20x1. Since full capital allowances are given on the cost of the asset, any residual value recovered on disposal is taxable.

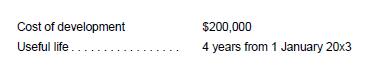

(b) Development expenditures

Development expenditures are capitalized as intangible assets. Amortization is on a straight line basis. The following tax deductions are allowed:

(i) $100,000 on 1 January 20x3 (ii) $100,000 on 1 January 20x4

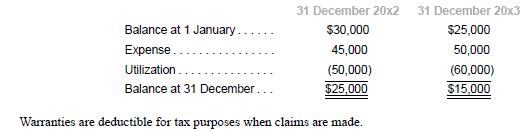

(c) Provision for warranties

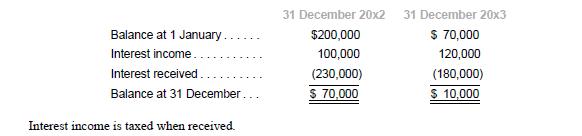

(d) Interest receivable

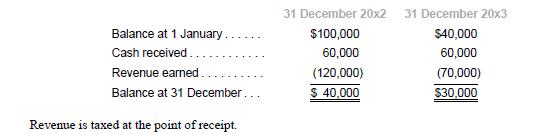

(e) Unearned revenue

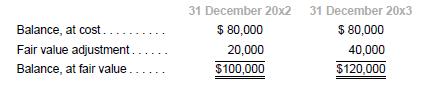

(f) Financial assets

The asset was acquired during 20x2. Fair value adjustment of $20,000 was taken to income statement in each of the two years. Income from the sale of financial assets is taxable. As of 31 December 20x3, no sale has been made of the financial assets.

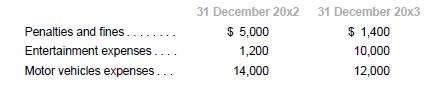

(g) Disallowed items included in net income

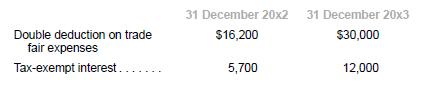

(h) Tax exemptions and reliefs granted

(i) Profit before tax ![]()

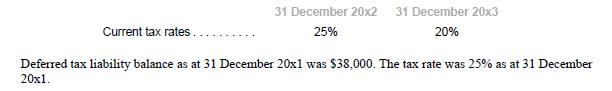

(j) Tax rates

Required

1. Prepare the tax computation for the years ended 31 December 20x2 and 20x3.

2. Using the balance sheet liability approach, and showing the carrying amount and the tax base for each asset and liability, determine the deferred tax liability balance as at:

(a) 31 December 20x2; and

(b) 31 December 20x3.

3. Prepare the journal entries to record the tax expense for 20x2 and 20x3.

4. Perform the analytical check on tax expense for 20x2 and 20x3.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah