Crandic Company and Modest Corporation joined together on January 1, 20X2, in a business combination treated as

Question:

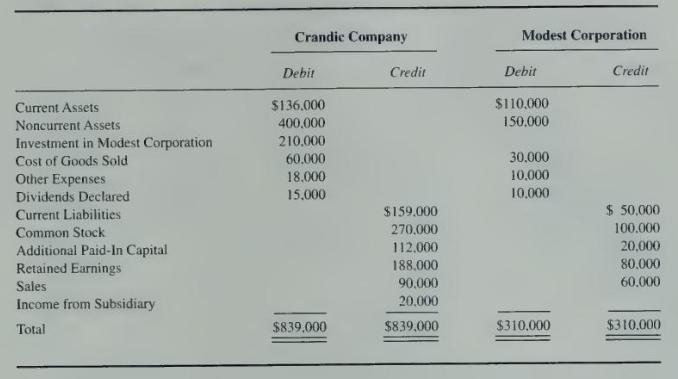

Crandic Company and Modest Corporation joined together on January 1, 20X2, in a business combination treated as a pooling of interests. Simplified trial balances for the two companies on December \(31,20 \times 2\), are as follows:

The pooling of interests was accomplished by Crandic Company's issuing 3,500 shares of its \(\$ 20\) par value stock to acquire 100 percent of the \(\$ 10\) par value shares of Modest Corporation.

\section*{Required}

a. Determine the amounts to be reported in the consolidated balance sheet immediately following the business combination for each of the following:

(1) Common stock.

(2) Additional paid-in capital.

(3) Retained earnings.

(4) Investment in Modest Corporation.

b. What amount of total assets will be reported in the consolidated balance sheet as of December 31, 20X2?

c. If comparative statements for \(20 \mathrm{X} 1\) and \(20 \times 2\) are prepared, what portion of the \(20 \mathrm{X} 1\) income statement data for Modest Corporation will be included in the consolidated income statement? Explain.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King