Crow Corporation purchased 70 percent of the voting common stock of West Company on January (1,20 times

Question:

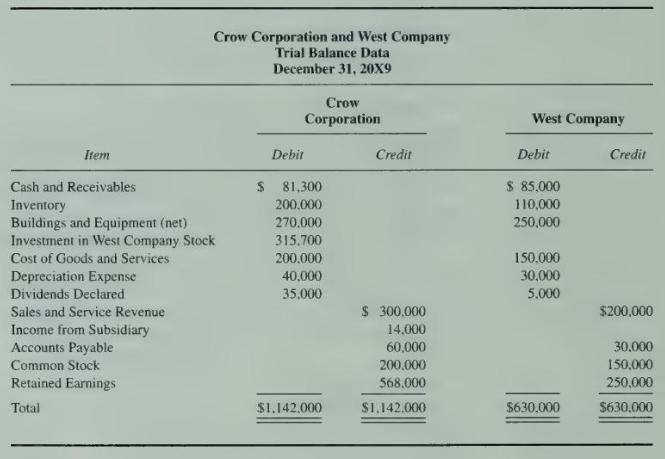

Crow Corporation purchased 70 percent of the voting common stock of West Company on January \(1,20 \times 7\), for \(\$ 291,200\). On that date, the book value of West Company's net assets was \(\$ 380,000\), and their book values were equal to fair values, except for land that had a fair value \(\$ 14,000\) greater than book value. The amount attributed to goodwill as a result of the purchase of West Company shares is not amortized.

On January 1, 20X9, the inventory of Crow Corporation contained unrealized intercompany profits recorded by West Company in the amount of \(\$ 30,000\). The inventory of West Company on that date contained \(\$ 15,000\) of unrealized intercompany profits recorded on the books of Crow Corporation. Both companies sold their ending 20X8 inventories to unrelated companies in 20X9.

During 20X9, West Company sold inventory costing \(\$ 37,000\) to Crow Corporation for \(\$ 62,000\). All inventory purchased from West Company during 20X9 is held by Crow Corporation on December 31, 20X9. Also during 20X9, Crow Corporation sold goods costing \(\$ 54,000\) to West Company for \(\$ 90,000\). West Company continues to hold \(\$ 20,000\) of its purchase from Crow Corporation on December 31, 20X9.

On January 1, 20X6, Crow Corporation paid \(\$ 95,000\) to West Company for equipment purchased by West on January \(1,20 \mathrm{X} 1\), for \(\$ 120,000\). The total estimated economic life of 15 years for the equipment remains unchanged.

\section*{Required}

a. Prepare all eliminating entries needed to complete a consolidation workpaper as of December \(31,20 \times 9\).

b. Prepare a consolidation workpaper as of December 31, 20X9.

c. Prepare a reconciliation between the balance in retained eamings reported by Crow Corporation on December \(31,20 \mathrm{X} 9\), and consolidated retained earnings.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King