Crystal Corporation owns 60 percent of the common shares of Evans Company. Balance sheet data for the

Question:

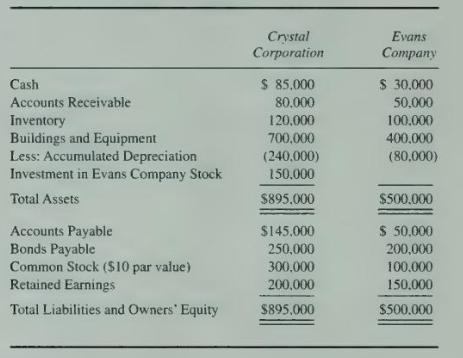

Crystal Corporation owns 60 percent of the common shares of Evans Company. Balance sheet data for the companies on December 31, 20X2, are as follows:

The bonds of Crystal Corporation and Evans Company pay annual interest of 8 percent and 10 percent, respectively. The bonds of Crystal Corporation are not convertible. The bonds of Evans Company can be converted into 10,000 shares of Evans Company stock anytime after January 1, 20X1. A federal income tax rate of 40 percent is applicable to both companies. Evans Company reports net income of \(\$ 30,000\) for \(20 \mathrm{X} 2\) and pays dividends of \(\$ 15,000\), while Crystal Corporation reports income from its separate operations of \(\$ 45,000\) and pays dividends of \(\$ 25,000\).

\section*{Required}

Compute basic and diluted earnings per share for the consolidated entity for \(20 \mathrm{X} 2\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King