Friendly College is a small, privately supported liberal arts college. The college uses a fund structure: however,

Question:

Friendly College is a small, privately supported liberal arts college. The college uses a fund structure: however, it prepares its financial statements in conformance with FASB 117.

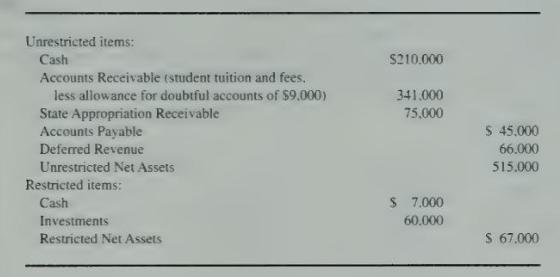

Partial balance sheet information as of June 30. 20 2 . is given as follows:

The following transactions occurred during the fiscal year ended June 30. 20 3 :

1. On July 7.20X2, a gift of \(\$ 100,000\) was received from an alumnus. The alumnus requested that half the gift be restricted to the purchase of books for the university library and the remainder be used for the establishment of an endowed scholarship fund. The alumnus further requested that the income generated by the scholarship fund be used annually to award a scholarship to a qualified disadvantaged student. On July 20, 20X2, the board of trustees resolved that the funds of the newly established scholarship endowment fund would be invested in savings certificates. On July 21, 20X2, the savings certificates were purchased.

2. Revenue from student tuition and fees applicable to the year ended June \(30,20 \times 3\), amounted to \(\$ 1,900,000\). Of this amount. \(\$ 66,000\) was collected in the prior year, and \(\$ 1,686,000\) was collected during the year ended June 30. 20X3. In addition, on June 30, 20X3, the university had received cash of \(\$ 158.000\) representing deferred revenue fees for the session beginning July \(1,20 \times 3\).

3. During the year ended June 30. 20X3 , the university had collected \(\$ 349.000\) of the outstanding accounts receivable at the beginning of the year. The balance was determined to be uncollectible and was written off against the allowance account. On June 30, 20X3, the allowance account was increased by \(\$ 3.000\).

4. During the year, interest charges of \(\$ 6.000\) were earned and collected on late student fee payments.

5. During the year the state appropriation was received. An additional unrestricted appropriation of \(\$ 50.000\) was made by the state but had not been paid to the university as of June 30.20X3.

6. An unrestricted gift of \(\$ 25,000\) cash was received from alumni of the university.

7. During the year. restricted investments of \(\$ 21,000\) were sold for \(\$ 26,000\). Investment income amounting to \(\$ 1,900\) was received.

8. During the year unrestricted operating expenses of \(\$ 1,777,000\) were recorded. On June 30, 20X3, \(\$ 59,000\) of these expenses remained unpaid.

9. Restricted current funds of \(\$ 13,000\) were spent for authorized purposes during the year.

10. The accounts payable on June 30, 20X2, were paid during the year.

11. During the year, \(\$ 7,000\) interest was earned and received on the savings certificates purchased in accordance with the board of trustees' resolutions, as discussed in transaction 1.

\section*{Required}

a. Prepare a comparative balance sheet for Friendly College as of June 30, 20X2, and June 30, 20X3.

b. Prepare a statement of activities for Friendly College for the year ended June 30, 20X3.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King