Gross Corporation issued ($ 500,000) par value, 10 -year, bonds at 104 on January 1, 20X1, which

Question:

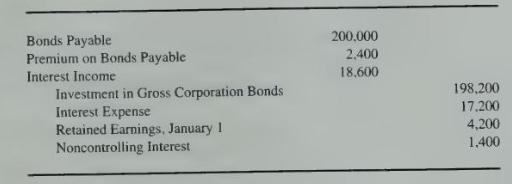

Gross Corporation issued \(\$ 500,000\) par value, 10 -year, bonds at 104 on January 1, 20X1, which were purchased by Independent Corporation. On July 1, 20X5, Rupp Corporation purchased \(\$ 200,000\) par value bonds of Gross Corporation from Independent Corporation. The bonds pay interest of 9 percent annually on December 31. In preparing consolidated financial statements for Gross Corporation and Rupp Corporation at December 31, 20X7, the following eliminating entry was required:

\section*{Required}

With the information given, answer each of the following questions. Show how your answer was derived.

a. Is Gross Corporation or Rupp Corporation the parent company? How do you know?

b. What percentage of the subsidiary's ownership is held by the parent?

c. What amount did Rupp Corporation pay when it purchased the bonds on July 1, 20X5?

d. Was a gain or a loss on bond retirement included in the \(20 \times 5\) consolidated income statement? What amount was reported?

e. If \(20 \times 7\) consolidated net income of \(\$ 70,000\) would have been reported without the above eliminating entry, what amount will actually be reported?

f. Will income to noncontrolling interest reported in \(20 \times 7\) increase or decrease as a result of the above eliminating entry? By what amount?

g. Prepare the eliminating entry needed to remove the effects of the intercorporate bond ownership in completing a three-part consolidation workpaper at December 31, 20X8.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King