Question

James A. and Ella R. Polk, ages 70 and 65, respectively, are retired physicians who live at 3319 Taylorcrest Street, Houston, Texas 77079. Their three

James A. and Ella R. Polk, ages 70 and 65, respectively, are retired physicians who live at 3319 Taylorcrest Street, Houston, Texas 77079. Their three adult children (Benjamin Polk, Michael Polk, and Olivia Turner) are mature and responsible persons.

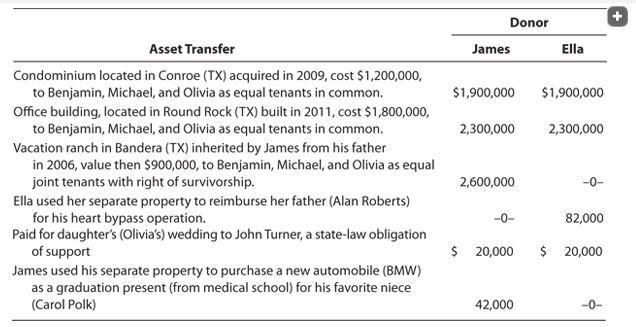

The Polks have heard that some in Congress have proposed lowering the Federal gift tax exclusion to $3,000,000. Although this change likely will not occur, the Polks believe that they should take advantage of the more generous exclusion available under existing law. Thus, the Polks make transfers of many of their high-value investments. These and other gifts made during the year are summarized below.

Prepare 2019 gift tax returns (Form 709) for both of the Polks to compute the total taxable gifts (line 3) for James and Ella; stop with line 3 of page 1, but complete pages 2 and 3 of the return.

An election to split gifts is made. The Polks have made no taxable gifts in prior years. Relevant Social Security numbers are 123-45-6789 (James) and 123-45-6788 (Ella).

Asset Transfer Condominium located in Conroe (TX) acquired in 2009, cost $1,200,000, to Benjamin, Michael, and Olivia as equal tenants in common. Office building, located in Round Rock (TX) built in 2011, cost $1,800,000, to Benjamin, Michael, and Olivia as equal tenants in common. Vacation ranch in Bandera (TX) inherited by James from his father in 2006, value then $900,000, to Benjamin, Michael, and Olivia as equal joint tenants with right of survivorship. Ella used her separate property to reimburse her father (Alan Roberts) for his heart bypass operation. Paid for daughter's (Olivia's) wedding to John Turner, a state-law obligation of support James used his separate property to purchase a new automobile (BMW) as a graduation present (from medical school) for his favorite niece (Carol Polk) James $1,900,000 Donor 2,300,000 2,600,000 -0- Ella $1,900,000 2,300,000 -0- 82,000 $ 20,000 $ 20,000 42,000 -0-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the 2019 gift tax returns Form 709 for both James and Ella Polk and compute the total taxable gifts for each we need to follow the given in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started