H plc was established in 1996 to develop advanced computer software. The company was established with the

Question:

H plc was established in 1996 to develop advanced computer software. The company was established with the financial backing of B Bank. B Bank invested £2 million in H plc’s share capital, buying 2 million £1 shares at par. The agreement was that B Bank would leave this investment in place for five years. At the end of that period, H plc would buy the shares back from B Bank at a price that reflected the company’s success during that period.

An independent accountant advised that B Bank’s 2 million shares in H plc were worth

£4.5 million. The shares were repurchased on 30 April 2001 for that amount.

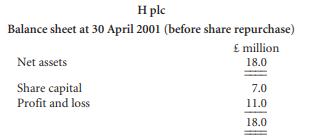

H plc’s balance sheet immediately before the repurchase was as follows:

The net assets figure includes £8.0 million cash.

Required:

(a) Prepare H plc’s balance sheet as it would appear immediately after the share repurchase. (5 marks)

(b) When a company repurchases its shares, it must normally make a transfer from its profit and loss account to its capital redemption reserve (CRR). It has been suggested that this transfer is necessary to protect the company’s lenders. Explain how the transfer to the CRR protects the interests of lenders when a company repurchases its shares. (10 marks)

(c) Explain why companies are permitted to buy back their own shares. (5 marks)

CIMA, Financial Accounting – UK Acounting Standards, May 2001 (20 marks)

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780073526744

7th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey