Islay plc has acquired the following unincorporated businesses: (1) Savalight, a business specialising in the production of

Question:

Islay plc has acquired the following unincorporated businesses:

(1) ‘Savalight’, a business specialising in the production of low-cost, energy efficient light bulbs, acquired on 1 June 1996 for £580 000. The identifiable assets and liabilities of the business had a book value of £550 000 and were valued at £500 000 on 1 June 1996. The company estimated the useful economic life of the goodwill arising at five years and has been amortising this through the profit and loss account. It was anticipated that the goodwill would have a residual value of £20 000.

(2) ‘Green Goods’, a business specialising in the distribution of a range of environmentally friendly products, acquired on 1 June 1997 for £1.8 million. The identifiable assets and liabilities of the business had a book value of £1.1 million and were valued at £1.3 million on 1 June 1997, including goodwill of the business of £150 000. The company estimated the useful economic life of goodwill arising at 25 years and has been amortising this through the profit and loss account.

(3) ‘Smart IT’, a business specialising in the distribution of computers, acquired on 1 June 1998 for £900 000. The identifiable assets and liabilities of the business had a book value of £1 million and were valued at £1.2 million on 1 June 1998. Assume the major non-monetary assets in these amounts have a useful economic life of 15 years.

Islay plc revalued its tangible fixed assets during the year ended 31 May 1999 and created a revaluation reserve of £600 000. In addition, the company believes the goodwill arising on the purchase of ‘Savalight’ is now worth £350 000 and intends to reflect this in the financial statements for the year ended 31 May 1999.

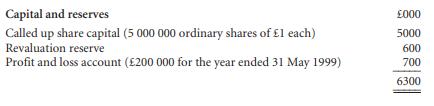

The company’s capital and reserves (before reflecting any adjustments for the above acquisitions) in the draft financial statements as at 31 May 1999 show:

Requirements

(a) Calculate and disclose the amounts for goodwill to be included in the financial statements for Islay plc for the year ended 31 May 1999, providing the following disclosures:

Balance sheet extracts Disclosure note for goodwill Disclosure note for movements on reserves. (13 marks)

(b) Explain the accounting treatment you have adopted for any goodwill arising in acquisitions (1) to (3) above, referring to the provisions of FRS 10, ‘Goodwill and Intangible Assets’, and noting any current or future action Islay plc will have to take on goodwill recognised. (4 marks)

ICAEW, Financial Reporting, June 1999 (17 marks)

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780073526744

7th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey