Elie plc acquired 80% of the 1 million ordinary share capital of Monans Ltd on 1 July

Question:

Elie plc acquired 80% of the £1 million ordinary share capital of Monans Ltd on 1 July 2001 by issuing 200 000 £1 ordinary shares. Elie plc’s ordinary shares were quoted at £17 on 1 July 2001. Expenses of the share issue amounted to £90000.

A further amount of £94 500 is payable in cash on 1 July 2002. Elie plc’s borrowing rate is 5%.

A further contingent consideration of shares with a value of £500 000 is dependent on Monans Ltd achieving a 10% increase in turnover in the year ended 31 October 2002. This would become due on 1 July 2003. Monans Ltd has achieved an increase in turnover over the past five years of 11%, 8%, 10%, 11% and 12% (from the earliest to the most recent year).

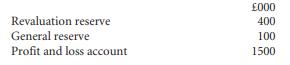

The net assets of Monans Ltd in its accounts as at 1 July 2001 were £3 million with fair value being £1 million higher than book value. Monans Ltd had the following reserves at 1 July 2001:

A further acquisition of shares took place on 1 September 2001 when Elie plc purchased 60% of the £500000 preference shares of Monans Ltd for £390000.

Elie plc is intending to write off any goodwill arising over 9 years, charging a full year in the year of acquisition.

Elie plc has identified the following matters not reflected in the financial statements of Monans Ltd as at 1 July 2001:

(1) A contingent asset amounting to £200 000 existed at 1 July 2001; the company’s lawyers consider it is probable this will be received in the near future.

(2) Operating losses of £300000 are expected after acquisition.

(3) Reorganisation costs of £100 000 are to be incurred to bring Monans Ltd’s systems into line with those of the group.

(4) A fall in stock value of £50 000 on 5 July 2001 due to a fire at a warehouse. The stock now has a net realisable value of £5000.

Requirements

(a) Calculate the amount of goodwill arising on the acquisition of Monans Ltd that would be shown in the group accounts of Elie plc for the year ended 30 June 2002.

(8 marks)

(b) Explain your calculation of the goodwill arising in

(a) including your treatment of items (1) to (4) above, referring to appropriate accounting standards. (12 marks)

ICAEW, Financial Reporting, June 2002 (20 marks)

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780073526744

7th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey