FRS 11 Impairment of fixed assets and goodwill requires that all fixed assets and goodwill should

Question:

FRS 11 – Impairment of fixed assets and goodwill requires that all fixed assets and goodwill should be reviewed for impairment where appropriate and any impairment loss dealt with in the financial statements.

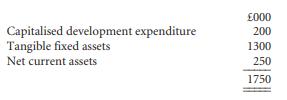

The XY group prepares financial statements to 31 December each year. On 31 December 1998 the group purchased all the shares of MH Ltd for £2 million. The fair value of the identifiable net assets of MH Ltd at that date was £1.8 million. It is the policy of the XY group to amortise goodwill over 20 years. The amortisation of the goodwill of MH Ltd commenced in 1999. MH Ltd made a loss in 1999 and at 31 December 1999 the net assets of MH Ltd – based on fair values at 1 January 1999 – were as follows:

An impairment review at 31 December 1999 indicated that the value in use of MH Ltd at that date was £1.5 million. The capitalised development expenditure has no ascertainable external market value.

Requirements

(a) Describe what is meant by ‘impairment’ and briefly explain the procedures that must be followed when performing an impairment review. (12 marks)

(b) Calculate the impairment loss that would arise in the consolidated financial statements of the XY group as a result of the impairment review of MH Ltd at 31 December 1999.

(4 marks)

(c) Show how the impairment loss you have calculated in

(b) would affect the carrying values of the various net assets in the consolidated balance sheet of the XY group at 31 December 1999. (4 marks)

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780073526744

7th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey