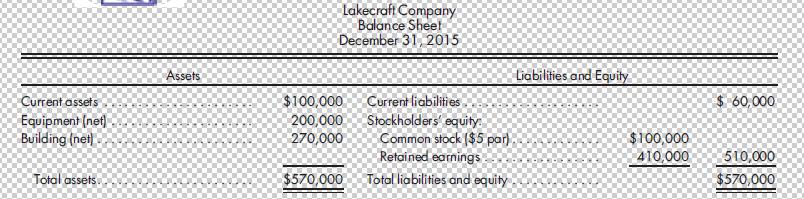

Lakecraft Company has the following balance sheet on December 31, 2015, when it is acquired for $950,000

Question:

Lakecraft Company has the following balance sheet on December 31, 2015, when it is acquired for $950,000 in cash by Argo Corporation:

All assets have fair values equal to their book values. The combination is structured as a tax-free exchange. Lakecraft Company has a tax loss carryforward of $300,000, which it has not recorded. The balance of the $300,000 tax loss carryover is considered fully realizable. Argo is taxed at a rate of 30%.

Record the acquisition of Lakecraft Company by Argo Corporation.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng

Question Posted: