Lance Corporation purchased 75 percent of the common stock of Avery Company at underlying book value on

Question:

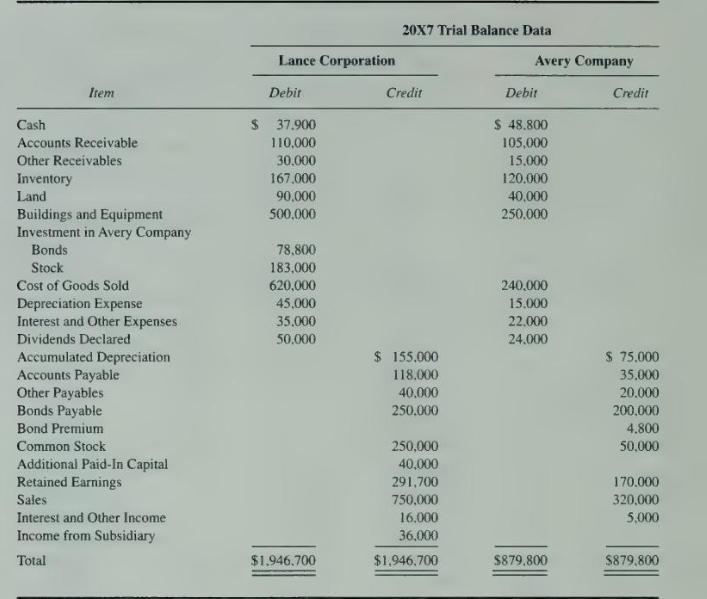

Lance Corporation purchased 75 percent of the common stock of Avery Company at underlying book value on January 1, 20X3. Trial balances for Lance Corporation and Avery Company on December \(31,20 \times 7\), are as follows:

During 20X7, Lance Corporation resold inventory purchased from Avery in 20X6. It cost Avery \(\$ 44,000\) to produce the inventory, and Lance purchased it for \(\$ 59,000\). In 20X7, Lance purchased inventory for \(\$ 40,000\) and sold it to Avery for \(\$ 60,000\). At December 31, 20X7, Avery continued to hold \(\$ 27,000\) of the inventory.

Avery issued \(\$ 200,0008\) percent 10 -year, first mortgage bonds on January 1, 20X4, at 104 . Lance Corporation purchased \(\$ 80,000\) of the bonds from one of the original owners for \(\$ 78,400\) on December 31, 20X5. Both companies use straight-line write-off of premiums and discounts. Interest is paid annually on December 31 .

\section*{Required}

a. What amount of cost of goods sold will be reported in the \(20 \times 7\) consolidated income statement?

b. What inventory balance will be reported in the December 31, 20X7, consolidated balance sheet?

c. Prepare the journal entry to record interest expense for Avery for \(20 \times 7\).

d. Prepare the journal entry to record interest income for Lance for \(20 \mathrm{X} 7\).

\(e\). What amount will be assigned to noncontrolling interest in the consolidated balance sheet prepared at December 31, 20X7?

f. Prepare all eliminating entries needed at December 31, 20X7, to complete a three-part consolidated working paper.

g. Prepare a consolidation workpaper for \(20 \times 7\) in good form.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King