On January 1, 20X5, Pond Corporation purchased 75 percent of the stock of Skate Company at underlying

Question:

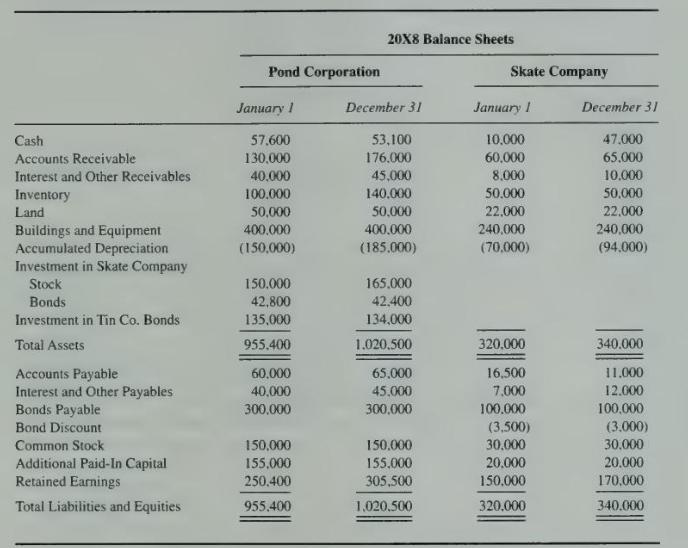

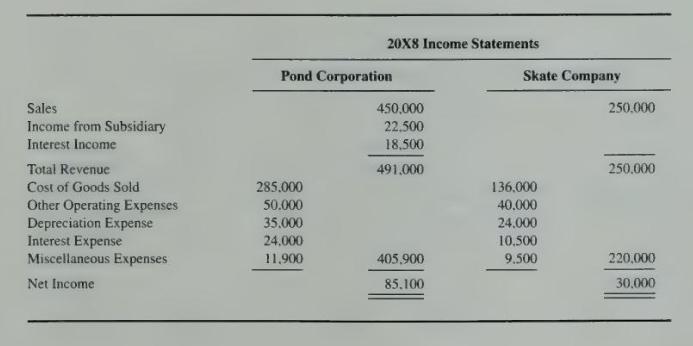

On January 1, 20X5, Pond Corporation purchased 75 percent of the stock of Skate Company at underlying book value. The balance sheets for Pond and Skate at January 1, 20X8, and December 31, 20X8, and income statements for \(20 \mathrm{X} 8\) were reported as follows:

1. Pond Corporation sold a building to Skate for \(\$ 65,000\) on December 31, 20X7. The building was purchased by Pond for \(\$ 125,000\) and depreciated on a straight-line basis over 25 years. At the time of sale, Pond reported accumulated depreciation of \(\$ 75,000\) and a remaining life of 10 years.

2. On July 1, 20X6, Skate sold land that it had purchased for \(\$ 22,000\) to Pond for \(\$ 35,000\). Pond is planning to build a new warehouse on the property prior to the end of 20X9.

3. Skate Company issued \(\$ 100,000\) par value, 10 -year bonds with a coupon rate of 10 percent on January 1, 20X5, at \(\$ 95,000\). On December 31, 20X7, Pond Corporation purchased \(\$ 40,000\) par value of Skate's bonds for \(\$ 42,800\). Both companies amortize bond premiums and discounts on a straight-line basis. Interest payments are made on July 1 and January 1.

4. Pond and Skate paid dividends of \(\$ 30,000\) and \(\$ 10,000\), respectively, in \(20 \mathrm{X} 8\).

\section*{Required}

a. Prepare all eliminating entries needed at December 31, 20X8, to complete a three-part consolidated working paper.

b. Prepare a three-part workpaper for 20X8 in good form.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King