Lofton Company owns 60 percent of the voting shares of Temple Corporation, purchased on May 17. 20X1,

Question:

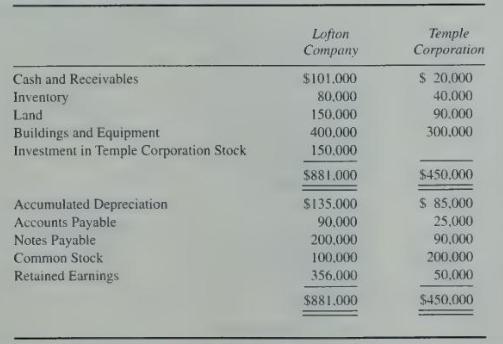

Lofton Company owns 60 percent of the voting shares of Temple Corporation, purchased on May 17. 20X1, at underlying book value. The permanent accounts of the companies on December 31, 20X6, contained the following balances:

On January 1, 20X2, Lofton Company paid \(\$ 100,000\) for equipment with an expected total economic life of 10 years. The equipment was depreciated on a straight-line basis with no residual value. Temple Corporation purchased the equipment from Lofton Company on December 31. 20X4, for \(\$ 91,000\).

Temple Corporation sold land it had purchased for \(\$ 30,000\) on February 23, 20X4, to Lofton Company for \(\$ 20,000\) on October 14, 20X5.

\section*{Required}

a. Prepare a consolidated balance sheet workpaper in good form as of December 31, 20X6.

b. Prepare a consolidated balance sheet as of December 31, 20X6.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King