Look Ahead & Co were instructed to value as at 31 December 1992 a minority holding of

Question:

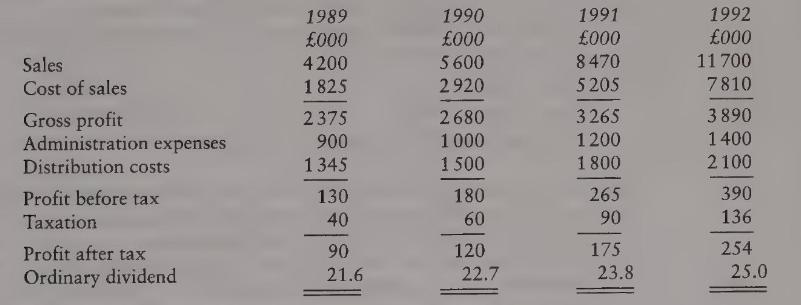

Look Ahead \& Co were instructed to value as at 31 December 1992 a minority holding of 10000 25p shares in Arbor Ltd held by D. Dodd who is considering disposing of his shareholding.

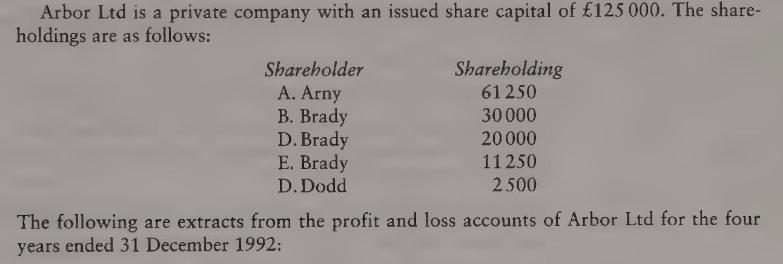

Arbor Ltd is a private company with an issued share capital of \(£ 125000\). The shareholdings are as follows:

The following additional information is available:

The gross dividend yields on quoted companies operating in the same sector were \(12 \%\) and the firm estimated that this yield should be increased to \(18 \%\) to allow for lack of marketability.

Assume an income tax rate of \(25 \%\).

\section*{Required}

(a) Discuss the relevance of dividends in the valuation of D. Dodd's shareholding on the assumption that it is sold to his son W. Dodd. Illustrate your answer from the data given in the question.

(b) Explain briefly the factors that the firm would take into account when:

(i) estimating the future net dividends;

(ii) estimating the investor's required gross yield.

(8 marks)

(c) Explain how the approach adopted by the firm when valuing a minority interest might be influenced by the size of the shareholding or its relative importance to the other shareholdings.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780273638339

6th Edition

Authors: Richard Lewis, David Pendrill