Musical Corporation purchases 80 percent of the common shares of Dustin Corporation on January 1, 20X2. On

Question:

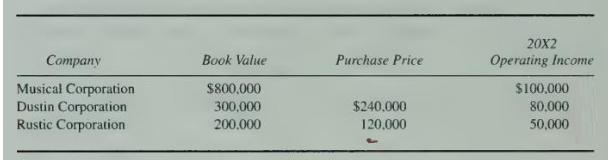

Musical Corporation purchases 80 percent of the common shares of Dustin Corporation on January 1, 20X2. On January 2, 20X2, Dustin Corporation purchases 60 percent of the common stock of Rustic Corporation. Information on company book values on the date of purchase and operating results for \(20 \mathrm{X} 2\) is as follows:

\section*{Required}

Select the correct answer for each of the following questions.

1. Consolidated net income for \(20 \times 2\) is:

a. \(\$ 180,000\).

b. \(\$ 188,000\).

c. \(\$ 194,000\).

d. \(\$ 234,000\).

2. The amount of \(20 \times 2\) income assigned to the noncontrolling interest of Rustic Corporation is:

a. \(\$ 0\).

b. \(\$ 20.000\).

c. \(\$ 30,000\).

d. \(\$ 50,000\).

3. The amount of \(20 \times 2\) income assigned to the noncontrolling interest of Dustin Corporation is:

a. \(\$ 10,000\).

b. \(\$ 16,000\)

c. \(\$ 22,000\).

d. \(\$ 26,000\).

4. The amount of income assigned to the noncontrolling interest in the \(20 \times 2\) consolidated income statement is:

a. \(\$ 20,000\)

b. \(\$ 22,000\).

c. \(\$ 42,000\)

d. \(\$ 46,000\).

5. Assume that Dustin Corporation pays \(\$ 160.000\), rather than \(\$ 120.000\), to purchase 60 percent of the common stock of Rustic Corporation. If the purchase differential is amortized over 10 years, the effect on \(20 \times 2\) consolidated net income will be a decrease of:

a. \(\$ 0\).

b. \(\$ 2,400\).

c. \(\$ 3,200\).

d. \(\$ 4,000\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King