Nick Andros of Streamline suggested that the company speculate in foreign currency as a partial hedge against

Question:

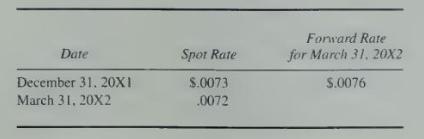

Nick Andros of Streamline suggested that the company speculate in foreign currency as a partial hedge against its operations in the cattle market, which fluctuates like a commodity market. On October 1, 20X1. Streamline bought a 180-day forward contract to purchase \(50,000,000\) yen ( \(¥\) ) at a forward rate of \(¥ 1=\$ .0075\) when the spot rate was \(\$ .0070\). Other exchange rates were as follows:

\section*{Required}

a. Prepare all journal entries related to Streamline Company's foreign currency speculation from October 1, 20X1, through March 31, 20X2, assuming the fiscal year ends on December 31, \(20 \mathrm{X} 1\).

b. Did Streamline Company gain or lose on its purchase of the forward contract? Explain.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King