On 1 January 20x1, Delco Company initiated a share-based compensation plan for its ten employees. Under the

Question:

On 1 January 20x1, Delco Company initiated a share-based compensation plan for its ten employees. Under the plan, each employee was given two choices: either a right to a cash payment equal to the value of 10,000 shares

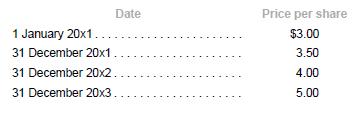

(also known as “phantom” shares), or 11,000 shares. If the latter alternative was chosen, the employee must hold the shares for three years. The grant vested only if the employee completed three years’ of service from the date of the grant. The following information relates to Delco’s share price at various relevant dates:

Delco did not expect any of its executives to leave in the next three years and did not intend to pay dividends during this period. The estimated fair value of the share alternative at 1 January 20x1 was $2.80 per share. This estimate took into account the effects of the post-vesting transfer restrictions. None of the employees had left Delco. Ignore taxation.

Required

1. Calculate the fair value of each of the alternatives at the grant date.

2. Calculate the remuneration expense for 20x1, 20x2 and 20x3 assuming:

(a) The employees chose the cash alternative at the end of 20x3.

(b) The employees chose the equity alternative at the end of 20x3.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah